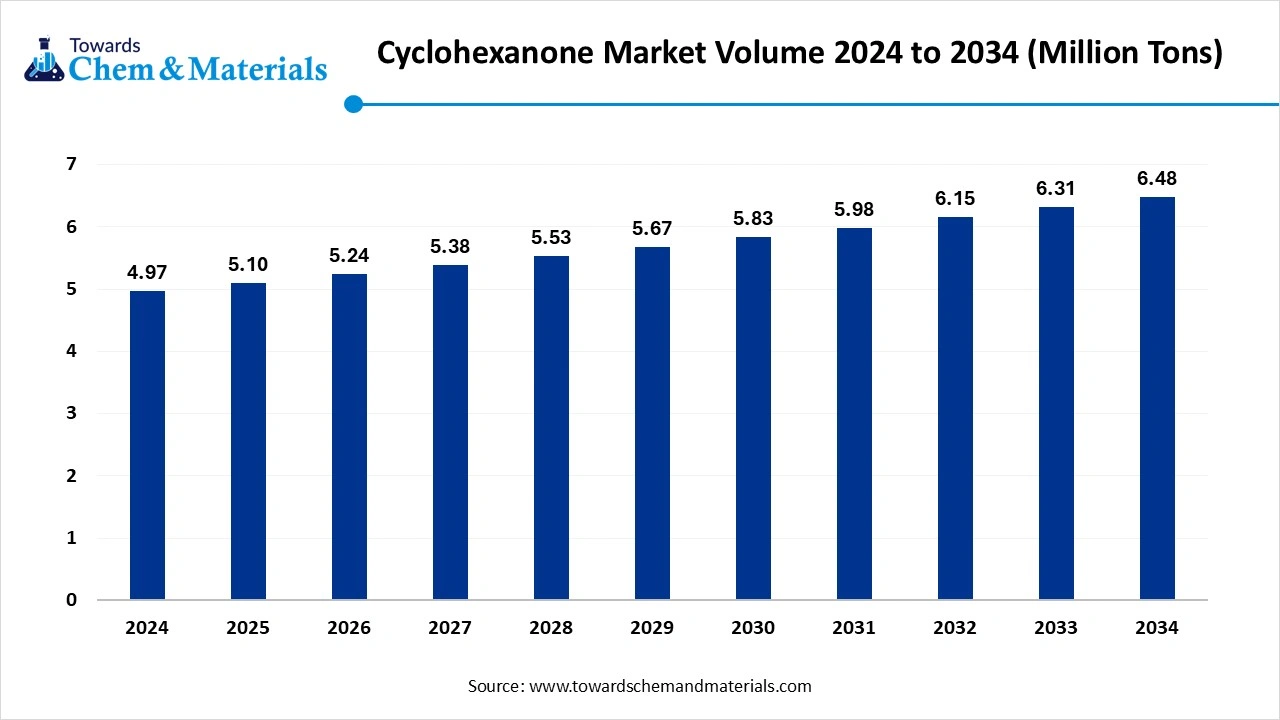

Cyclohexanone Market Volume to Worth Around 6.48 Million Tons by 2034

According to Towards Chem and Materials consultants, the global cyclohexanone market volume was estimated at 4.97 million tons in 2024 and is expected to be worth around 6.48 million tons by 2034, growing at a compound annual growth rate (CAGR) of 2.70% over the forecast period from 2025 to 2034.

Ottawa, July 15, 2025 (GLOBE NEWSWIRE) -- The global cyclohexanone market volume is calculated at 4.97 million tons in 2024, grows to USD 5.10 million tons in 2025, and is projected to reach around 6.48 million tons by 2034, A study published by Towards chem and Materials a sister firm of Precedence Research.

Cyclohexanone is a clear, oily liquid most used as an intermediate for the manufacture of nylon, especially nylon 66 and nylon 6, as it goes through the processes to create caprolactam and adipic acid. The market is driven by an increase in demand in the automotive, coatings, textiles, and the multitude of other process industries that use nylon-based products.

As industrialization and infrastructure development grows, particularly in the Asia Pacific region, the market will also expand however rising variations in raw material price, plus local regulations restricting it potential toxicity, may limit growth. Technological developments in production methods and new sustainable and biodegradable alternatives may present possible future growth scenarios for this application-driven market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.towardschemandmaterials.com/download-sample/5583

Cyclohexanone Market Report Highlights

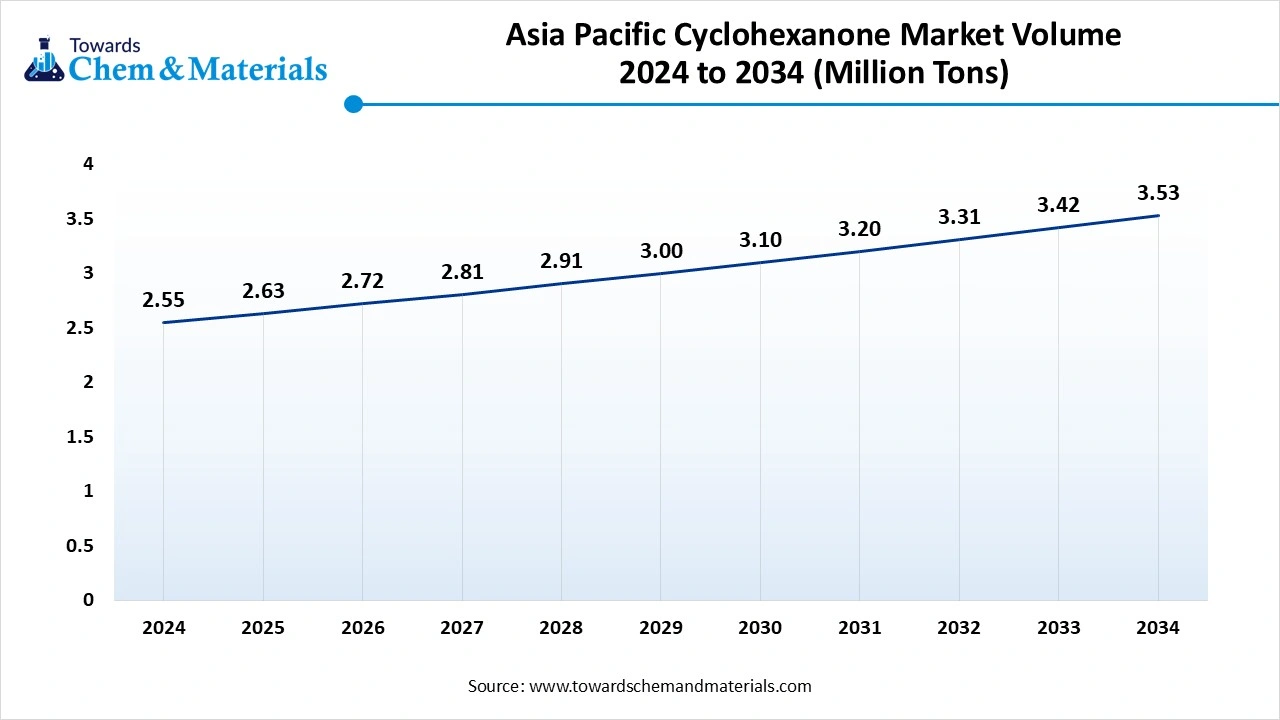

- The Asia Pacific cyclohexanone market Volume accounted for USD 2.63 million tons in 2025 and is forecasted to hit around USD 3.53 million tons by 2034, representing a CAGR of 3.31% from 2025 to 2034.

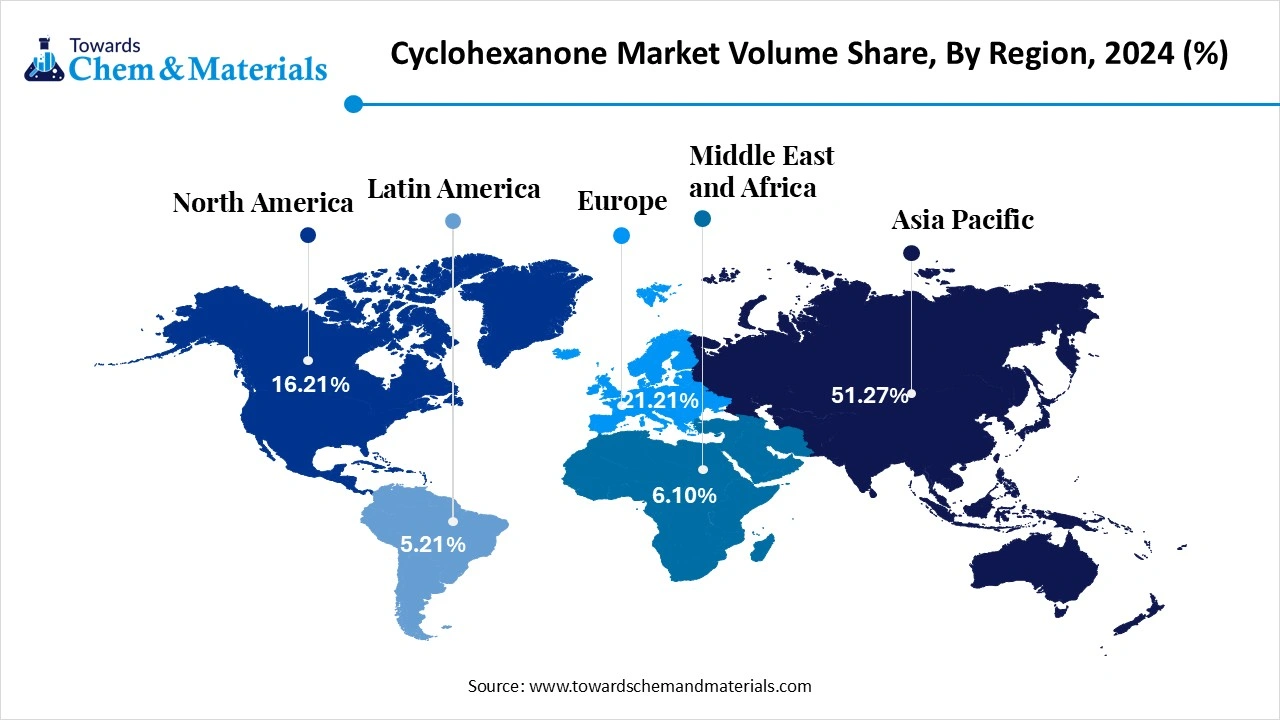

- The Asia Pacific cyclohexanone market held the largest volume Share of 51.27% of the global market in 2024.

- The North America Cyclohexanone market is expected to register the fastest CAGR of 1.98% over the forecast period by 2025-2034

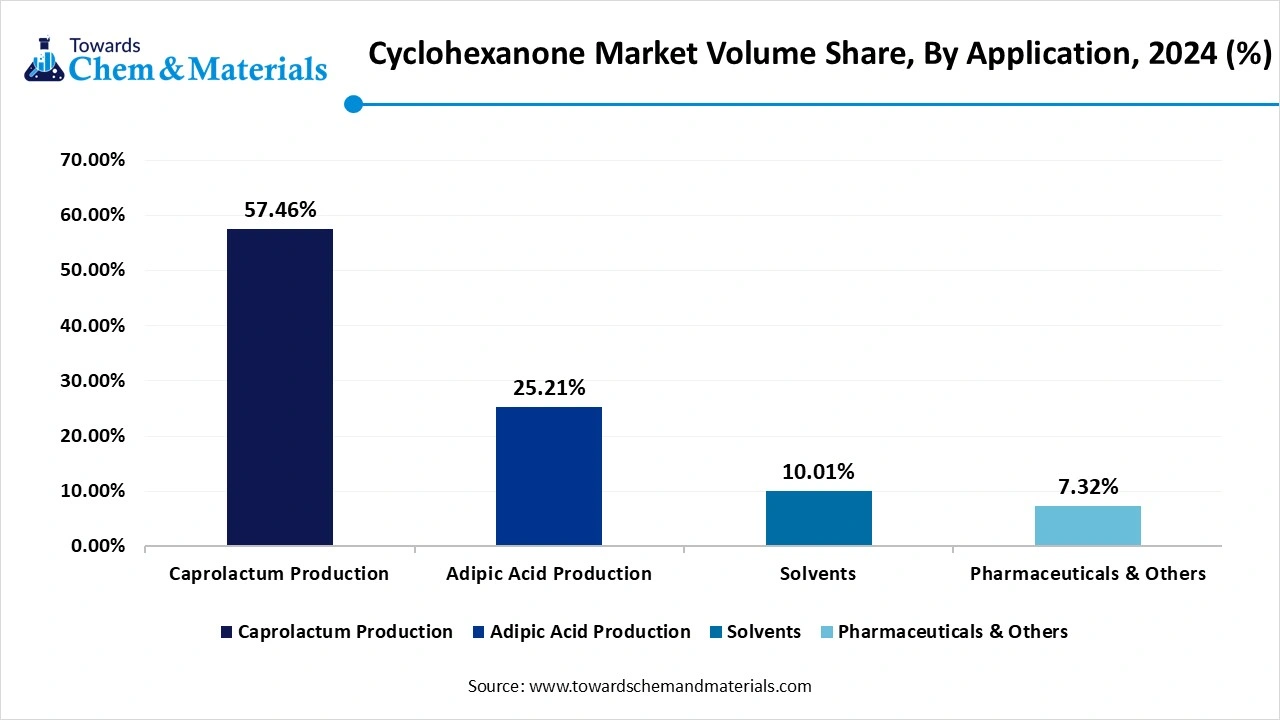

- By Application, the caprolactam production segment dominated the market with the largest volume Share of 57.46% in 2024.

- By Application, the adipic acid production segment is projected to grow at the fastest CAGR of 3.48% over the forecast period by 2025-2034

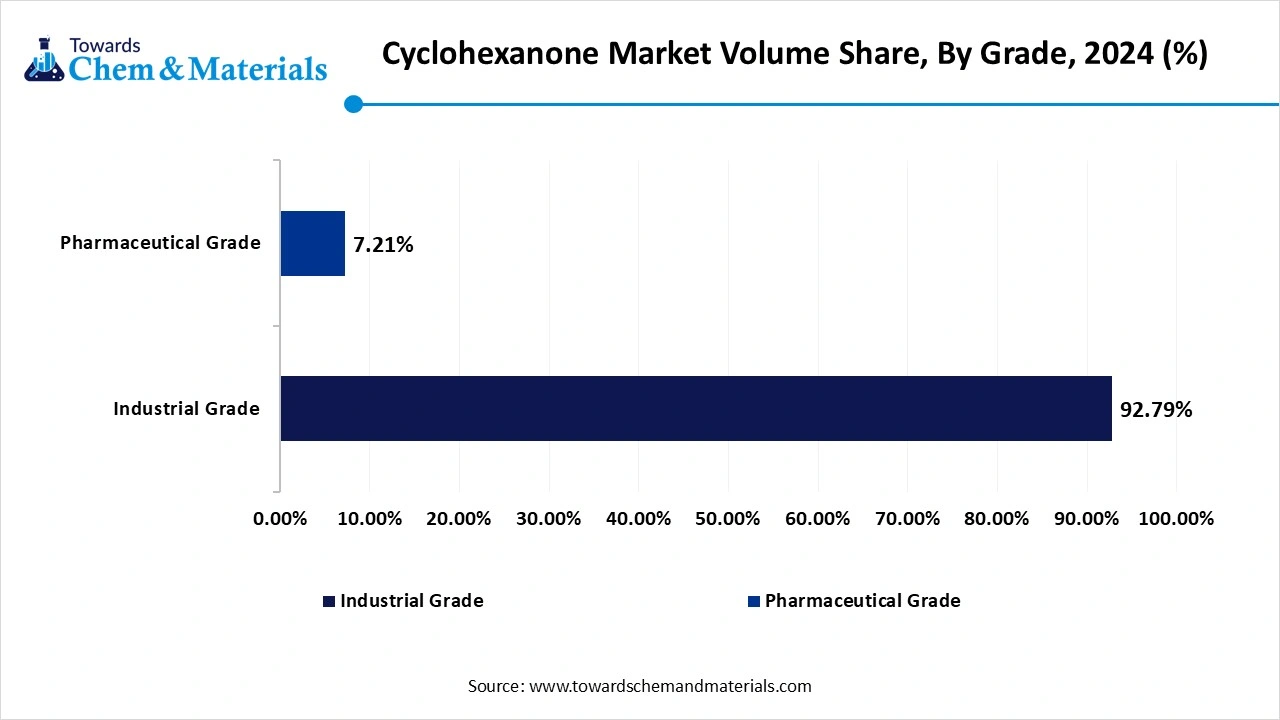

- By Grade, the industrial grade segment led the market with a volume Share of 92.79% in 2024

- By Grade, the pharmaceutical grade segment is projected to grow at the fastest CAGR of 11.28% over the forecast period.

Immediate Delivery Available | Buy This Databook@ https://www.towardschemandmaterials.com/download-databook/5583

Cyclohexanone Market Current Trends

- Rising Nylon Demand- Cyclohexanone is a precursor to the nylon-based chemicals caprolactam and adipic acid. The increase in nylon manufacturing in automotive, electronics, and textile industries is a principal driver of growth in the market.

- Focus on sustainable, bio-based alternatives- Globally, growing environmental issues from petrochemical based chemicals and increasing regulations are prompting some companies to pursue bio-based cyclohexanone as a sustainable alternative.

-

Technological development in production- new developments in catalytic oxidation and energy transformations allow companies to decrease emissions and improve yields as regulations are placed on emissions and costs need to be reduced by companies.

Immediate Delivery is Available | Get Full Report Access@ https://www.towardschemandmaterials.com/price/5583

Cyclohexanone Market in Can Expanding of Nylon-6 Production Induce Growth?

One of the top opportunities for growth in the cyclohexanone market is the skyrocketing global demand for Nylon-6, a leading downstream product. Cyclohexanone remains a necessary precursor in the caprolactam production process for Nylon-6. With recent trends towards lighter, durable materials in industries such as automotive, textiles, and electronics, Nylon-6 consumption has continued to climb.

For example, in May 2024, India's Ministry of Chemicals and Fertilizers outlined a strategy to ramp up domestic caprolactam and Nylon-6 production as part of the "Make in India" initiative. Moreover, the increasing uptake of engineered plastics within electric vehicles and the construction industry will stimulate subsequent demand for cyclohexanone and present openings for growth to cyclohexanone producers.

Cyclohexanone Market Opportunity

Is the Shift Towards Green Solvents Creating New Opportunity for Cyclohexanone?

The major trend that may provide cyclohexanone producers with a new opportunity is the shifting away from existing solvent usage to environmentally sustainable solvents (green solvents) in paints, coatings, and adhesives. In early 2025, the European Chemicals Agency (ECHA) introduced new limits on solvent emissions which will require pollutants producing industries to comply with the new limits and remove existing solvent products from their available products.

Cyclohexanone has numerous applications as a solvent, and with increased demand for low Voc (volatile organic compound) formulations, particularly in the Asia Pacific, the application range for cyclohexanone as a solvent is anticipated to grow. A regulatory push, coupled with sustainable product development, is creating new innovative growth opportunities for manufacturers.

Cyclohexanone Market Limitations and Challenges

- Environmental and Health Risks- Cyclohexanone is a hazardous chemical that is both toxic and flammable. Prolonged exposure to cyclohexanone is a health risk to workers and presents a risk of environmental contamination, requiring strict handling guidelines and limiting the prevalence of cyclohexanone in sensitive industrial environments.

- Regulatory Pressures on Petrochemical Derivatives- Increasingly stringent environmental regulations around petrochemicals in North America and Europe are forcing manufacturers to seek greener alternatives to chemicals like cyclohexanone. Very well could limit the use of cyclohexanone in favour of bio-based or sustainable chemical substitutes.

-

Volatility Associated with Price of Raw Materials- The price for cyclohexanone is market driven, based largely on crude oil and benzene prices. Volatility in global oil prices creates significant uncertainty regarding cost of production and profitability, leading to reluctance for investment into cyclohexanone-based production for the future.

Cyclohexanone Market Segmentation Insights

Application Insights

What Made Caprolactam the Dominant Segment in the Cyclohexanone Market in 2024?

The caprolactam segment dominated the market in 2024, due very heavy consumption in producing nylon-6, which is used extensively in textiles, automotive parts, and industrial end-uses. This dominance will persist due to increasing universal demand for lightweight automotive materials and durable textiles. Caprolactam's involvement in numerous industrial supply chains, coupled with consistent production of fibers and engineering plastics, highlights a consistent demand for cyclohexanone as an essential raw material which continues to position caprolactam's production as the strongest player in the application segment.

The solvents segment is anticipated to grow rapidly in the market during the forecast period, as the material is increasingly being used as an industrial and chemical solvent in paints, coatings, dyes, and pesticides, given its excellent solubility and evaporation characteristics. There is growing demand for high-performance paint and coatings in the construction and automotive industries, which is contributing to demand for solvents. Of note is the rising demand for pesticides in agriculture that boosts demand for solvents. There are also environmental regulations that are driving the shift towards safer and more effective solvents. All these factors are likely to help grow the solvents segment rapidly.

Cyclohexanone Market Volume Share, By Application 2024-2034 (%)

| By Application | Market Volume Share, 2024 (%) | Market Volume- 2024 (Million Tons ) | Market Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR(2025 - 2034) | |||

| Caprolactum Production | 2.86 | 57.46 | % | 3.59 | 55.37 | % | 2.31 | % |

| Adipic Acid Production | 1.25 | 25.21 | % | 1.76 | 27.21 | % | 3.48 | % |

| Solvents | 0.50 | 10.01 | % | 0.73 | 11.21 | % | 3.86 | % |

| Pharmaceuticals & Others | 0.36 | 7.32 | % | 0.40 | 6.21 | % | 1.01 | % |

| Total | 4.97 | 100 | % | 6.48 | 100 | % | 2.69 | % |

Grade Insights

Which Grade Segment is Dominating the Cyclohexanone Market in 2024?

Technical grade segment dominated the market in 2024, as it is used explicitly for industrial purposes at moderate purity levels. This grade also achieves a balance of being cost-effective while providing practical performance in various formulations, works with sufficient remaining range of functionality, and is compatible with various downstream applications. These factors, along with being easy to manipulate, make this a great choice for industrial processes on large scales in both developed and developing economies.

Reagent grade segment is anticipated to show fastest growth in the market during the forecast period, due to factors like its stated purity and increasing demand for laboratory and analytical applications worldwide. This highest purity grade type of cyclohexanone is useful for scientific research, analytic testing, and chemical reactions that require precision due to the extremely high purity levels. As pharmaceutical and biotech research continue to grow worldwide, particularly in developing economies, so is the demand for solvents like reagent-grade cyclohexanone due to the need for accountability and high reliability.

Global Cyclohexanone Market Volume Share, By Grade 2024- 2034 (%)

| By Grade | Market Volume Share, 2024 (%) | Market Volume - 2024 (Million Tons ) | Market Volume Share, 2034 (%) | Market Volume - 2034 (Million Tons ) | CAGR(2025 - 2034) | |||

| Industrial Grade | 0.46 | 92.79 | % | 0.67 | 91.68 | % | 3.73 | % |

| Pharmaceutical Grade | 0.04 | 7.21 | % | 0.06 | 8.32 | % | 5.36 | % |

| Total | 0.50 | 100 | % | 0.73 | 100 | % | 3.86 | % |

Regional Insights

The Asia Pacific cyclohexanone market was valued at 2.55 million tons in 2024 and is projected to reach 3.53 million tons by 2034, expanding at a compound annual growth rate (CAGR) of 3.31% from 2025 to 2034.

Asia Pacific dominated the cyclohexanone market in 2024, owing to the fast growth of industries and some of the largest nylon manufacturers. Demand in the market was buoyed by booming chemical and textile production from countries that have expanding infrastructure and automotive manufacturing. Alongside the low-cost labor, ease of access to key raw materials, and continued growth and domestic consumption of nylon-based products, provides a good outlook for the region.

China Market Trend

China is the main and largest contributor to the market in Asia Pacific, owing to its chemical manufacturing capacity and growing downstream activity for caprolactam and adipic acid. The country has some of the largest producers along with major production capacities and is also one of the largest exporters of cyclohexanone and relevant intermediates. In China, there is also considerable government support for industrial modernization alongside an increase in investments into refining and chemicals complexes which provide the country with a competitive edge in exporting the product.

Why Europe showing up as the Fastest Growing Region in Cyclohexanone?

Europe expects the significant growth in the cyclohexanone market during the forecast period, primarily due to demand related to premium automotive and construction applications. While not the largest market, Europe is still significant due to advanced production capabilities and commitment to regulatory and legal frameworks that promote innovations in chemicals. European has legacy production facilities as well as growing trends in reshoring industrial activity. Behavioural change driven by usage of engineered plastics, coatings and the like, from cyclohexanone, primarily for industrial and consumer products is driving growth.

Global Cyclohexanone Market Volume Share, By Region 2024 - 2034 (%)

| By Region | Market Volume Share, 2024 (%) | Market Volume- 2024 (Million Tons ) | Market Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR(2025 - 2034) | |||

| North America | 0.81 | 16.21 | % | 0.98 | 15.12 | % | 1.98 | % |

| Europe | 1.05 | 21.21 | % | 1.24 | 19.11 | % | 1.62 | % |

| Asia Pacific | 2.55 | 51.27 | % | 3.53 | 54.46 | % | 3.31 | % |

| Latin America | 0.26 | 5.21 | % | 0.40 | 6.21 | % | 4.51 | % |

| Middle East & Africa | 0.30 | 6.10 | % | 0.33 | 5.10 | % | 0.87 | % |

| Total | 4.97 | 100 | % | 6.48 | 100 | % | 2.69 | % |

Recent Development

-

In January 2025: Cyclohexanone prices hold steady in the U.S. and Europe, with post-holiday market malaise dampening demand, and suppliers' prices remaining constant as inventories had stabilized throughout the holiday season.

More Insights in Towards Chem and Materials:

- Specialty Polymer Market : The global specialty polymer market volume was estimated at 17.71 million tons in 2024 and is predicted to increase from 19.25 million tons in 2025 to approximately 40.7 million tons by 2034, expanding at a CAGR of 8.67% from 2025 to 2034.

- Fluoropolymers Market : The global fluoropolymers market volume is calculated at 639.21 kilo tons in 2024, grew to 688.89 kilo tons in 2025 and is predicted to hit around 1351.23 kilo tons by 2034, expanding at healthy CAGR of 7.77% between 2025 and 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Bioresorbable Polymers Market : The global bioresorbable polymers market volume accounted for 1,121.0 kilotons in 2024 and is predicted to increase from 1,267.9 kilotons in 2025 to approximately 3,839.1 kilotons by 2034, expanding at a CAGR of 13.10% from 2025 to 2034.

-

Ammonium Sulfate Market : The global ammonium sulfate market size was valued at USD 3.51 billion in 2024 and is estimated to hit around USD 6.5 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.35% during the forecast period 2025 to 2034.

Cyclohexanone Market Competitive Landscape

- Gujarat State Fertilizers & Chemicals Limited (GSFC)- Only Indian manufacturer, 235 tpd (7 kt/month) capacity; purity 99.7% for caprolactam and adipic acid; meets local demand of 10–15 kt/month with imports supplementing

- Asahi Kasei Corporation- Tier-1 global player (40 % top‐tier share); integrated downstream caprolactam production; contributes through efficient, vertically integrated supply chains

- BASF- Leading global producer (10–12 % global capacity); produces standard and high-purity grades for pharmaceuticals & solvents; strong European hub via Ludwigshafen

- Domo Chemicals- Recognized Tier-1 producer (part of top 8–10), linked to caprolactam downstream integration in Europe

- Ostchem- Listed as key player; serves Eastern Europe through fertilizer/caprolactam value chains

- Fibrant- Tier-1 Dutch producer of caprolactam-linked cyclohexanone, contributing to top 40% global share

- Shreeji Chemicals.- Indian regional/niche suppliers; import and distribute industrial/technical grades domestically

- Qingdao Hisea Chem Co., Ltd.- Chinese supplier supporting domestic caprolactam/adipic acid production; part of Asia’s growing cyclohexanone capacity

- LUXI GROUP- Expanded capacity by 300 kt in 2024; key contributor to China’s 10.9 Mt total cyclohexanone output

- Chang Chun Group- Taiwan-based chemical producer; serves caprolactam and plasticizer markets

-

UBE Corporation- Japanese specialist (4–5% global share); produces ultra-pure grades (CYKETONE) for electronics and pharmaceuticals

Cyclohexanone Market Top Key Companies:

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Asahi Kasei Corporation

- BASF

- Domo Chemicals

- Ostchem

- Fibrant

- Shreeji Chemicals.

- JIGCHEM UNIVERSAL

- ARIHANT SOLVENTS AND CHEMICALS

- Qingdao Hisea Chem Co., Ltd.

- LUXI GROUP

- Chang Chun Group

- UBE Corporation

Cyclohexanone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Cyclohexanone Market

By Application

- Caprolactam

- Adipic Acid

- Solvents

- Paints & Dyes

- Agriculture

- Others

By Grade

- Technical Grade

- Reagent Grade

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5583

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.