Cyber Security Market Size to Surpass USD 878.48 Billion by 2034, Driven by AI, Cloud Security, and Regulatory Compliance

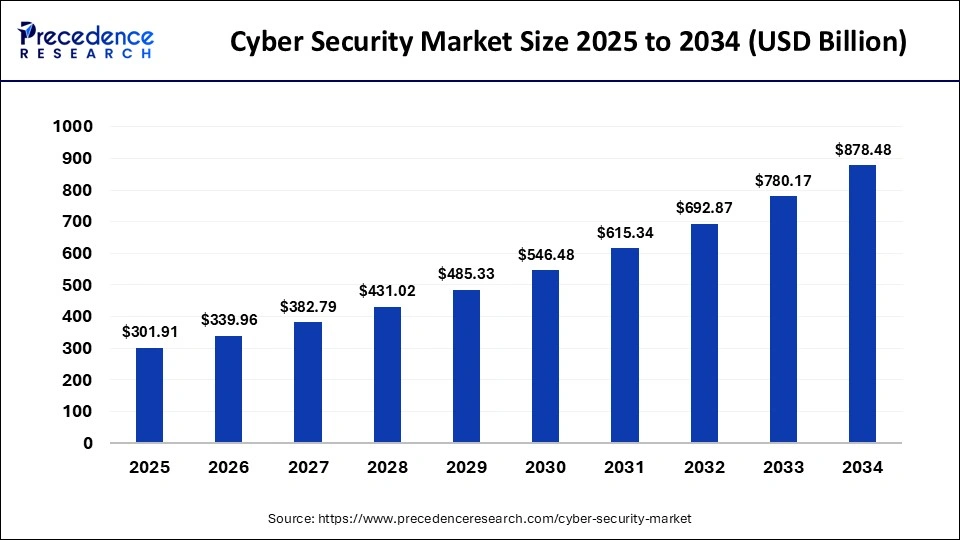

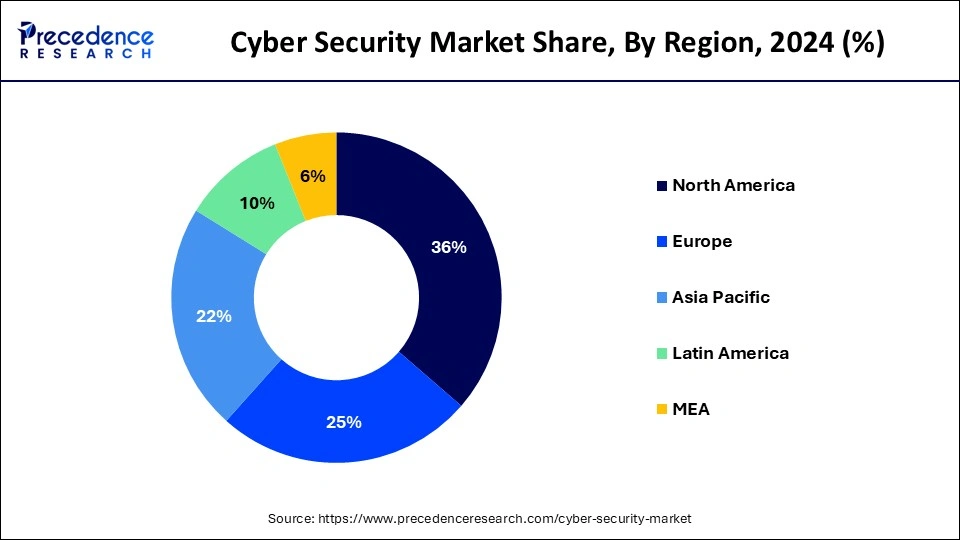

The global cyber security market size is calculated at USD 301.91 billion in 2025, up from USD 268.13 billion in 2024 and is expected to surpass USD 878.48 billion by 2034, According to Precedence Research. Rising cyber threats, data privacy laws, cloud adoption, and AI-powered solutions are fueling the market. North America dominates the market share, while Asia-Pacific is the fastest-growing region.

Ottawa, July 17, 2025 (GLOBE NEWSWIRE) -- In terms of revenue, the cyber security market was estimated at USD 268.13 billion in 2024 and is predicted to rise form USD 301.91 billion in 2025 to USD 878.48 billion by 2034, representing a strong CAGR of 12.60% from 2025 to 2034. The North America market size was valued at USD 96.88 billion in 2024 and is growing at a CAGR of 12.60%.

The pulse of these technological innovations is the increasing product and service efficiency, ongoing technological progression, population growth, urbanization, and environmental consciousness.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Preview the Report Before You Buy – Get Sample Pages @ https://www.precedenceresearch.com/sample/3258

Quick Facts: Cyber Security Market Insights:

- The global cybersecurity market is valued at $301.91 billion in 2025.

- The market is projected to reach $878.48 billion by 2034.

- It is expected to grow at a CAGR of 12.60% from 2025 to 2034.

- North America led the global market and held over 36% of the market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market from 2025 to 2034.

- By component, the services segment is expected to lead the market.

- By component, the software segment is growing at a solid CAGR from 2025 to 2034.

- By security type, the infrastructure protection segment dominated the market in 2024.

- By security type, the cloud security segment is expected to expand at the fastest CAGR from 2025 to 2034.

- By solution, the unified threat management (UTM) segment contributed the highest market share in 2024.

- By solution, the IAM segment is expected to grow at the fastest CAGR from 2025 to 2034

- By services, the managed services segment dominated the market in 2024.

- By services, the professional services segment is expected to grow at the fastest CAGR from 2025 to 2034.

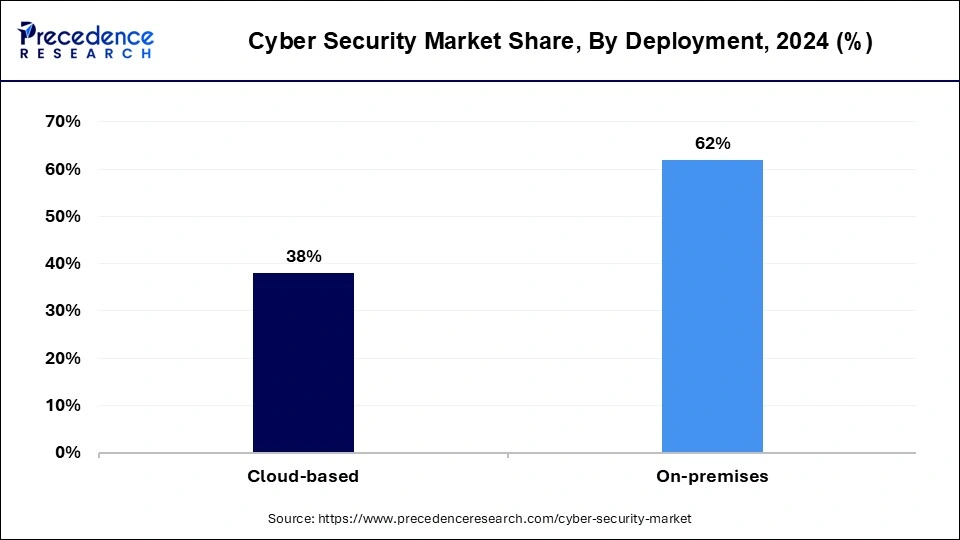

- By deployment, the on-premises segment held the major market share of 62% in 2024.

- By deployment, the cloud-based segment is expected to grow at the fastest CAGR from 2025 to 2034.

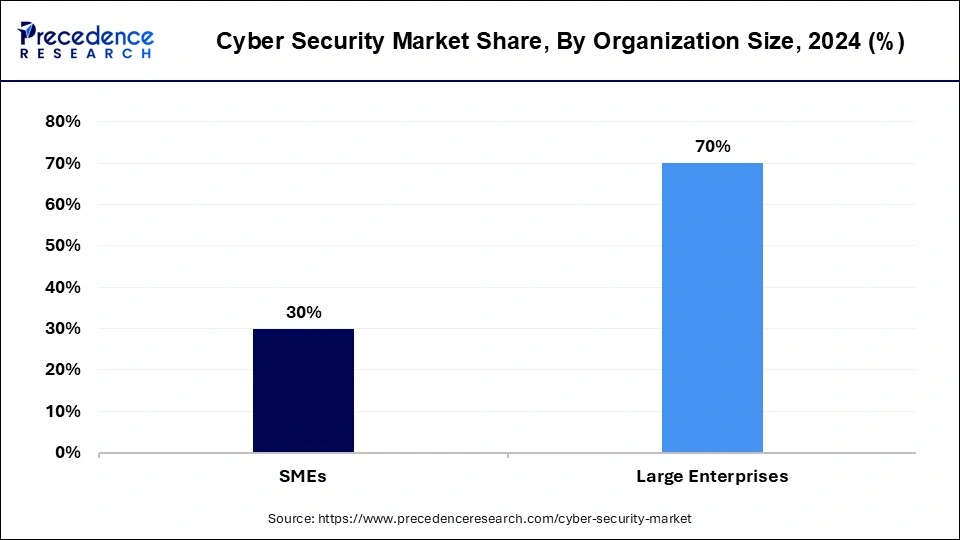

- By organization size, the large enterprises segment accounted for the highest market share of 70% in 2024.

- By organization size, the SMEs segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By application, the BFSI segment dominated the market in 2024.

- By application, the defense/government segment is expected to grow at the fastest CAGR from 2025 to 2034.

Cyber Security Market Overview and Industry Potential

What are the Solutions that Help Keep the Innovations Moving?

The cyber security market is driven by a pivotal role of cybersecurity as a prominent part of commercial security, which is a system by which data is protected by interconnected devices or components. It is possible for companies to identify security threats, detect events, and protect premises. These are the key drivers for security investments to predict, discourage, and prevent future threats.

Quality of service and product are the most important factors when investing in security technology. The commercial security systems market in India can be broadly classified into cybersecurity, electronic security, fire safety/detection/prevention, road safety, private and industrial security, and personal protective apparel and equipment.

The end users of safety and security products and services in India include airports, mass transportation system operators, government agencies, law enforcement and intelligence agencies, military and paramilitary forces, emergency and disaster management agencies, private security agencies, manufacturing operations, and commercial and non-commercial enterprises. In recent years, the Indian government has initiated a wide range of vital infrastructure projects, including new airports, seaports, highway development projects, urban rail systems, and the continued expansion of smart city technologies across the country.

Data Breaches Becoming Costlier

As per IBM’s 2024 study, the average cost of a data breach hit USD 4.45 million globally, with the healthcare sector incurring the highest per-record cost. This financial threat underscores the urgent need for proactive cybersecurity investments.

Dive into the Full Market Analysis@ https://www.precedenceresearch.com/cyber-security-market

Zero Trust Architecture Gains Momentum

Organizations are increasingly embracing Zero Trust Architecture (ZTA), where no user or system is inherently trusted, especially in hybrid work environments. According to IBM's 2024 Cost of a Data Breach report, ZTA adoption has helped organizations reduce breach costs by an average of USD 1 million

Top Emerging Electronic Security Technologies in 2024 in the Investment Hub by Securitas Technology

- Cloud Computing: 57% currently investing in 18% interested

- Adaptive Technology: 48% currently investing in 22% interested

- Artificial Intelligence: 46% currently investing in 21% interested

- Predictive Analytics: 40% currently investing in 26% interested

Cyber Security Market Major Trends

What are the Advanced Technological Solutions in the Cybersecurity Industry?

-

OS 3: A Smart-Home Product for Smart-Home Security: With this security product launched by a Control4 company, one can instantly view the status of their security systems, door locks, shades that are open or lights throughout the home and can take immediate control. It provides the best experience of any interface that you use. The Comfort screen provides weather details and allows you to adjust the temperature with a single tap.

-

Commercial Security Monitoring: In the next few months, data analytics and touchless biometrics will be most adopted by around 1 in 5 companies with their investments. Nearly two-thirds of organizations in the UK and the US have already invested in cloud computing and over half in the USA in artificial intelligence (AI) and adaptive technology. Access control and video surveillance are also the emerging technologies in the next few months.

XDR Sees Rising Adoption in Endpoint Security

With endpoint attacks rising by over 20% YoY, Extended Detection and Response (XDR) platforms are gaining traction for their real-time threat correlation and response capabilities across cloud, endpoint, and network environments. (Source: CrowdStrike 2024 Threat Report).

Cyber Security Market Growth Factors:

Which are the Brilliant Security Systems Driving the Growth of the Cybersecurity Industry?

-

Intrusion Detection System: It detects unauthorized entry into any premises and provides protection. A wireless system is with Wi-Fi or Bluetooth communication and depends on a smart wireless signal.

-

Commercial intrusion systems: They utilize motion detectors, glass-break sensors, magnetic contacts or sensors and other electronic security devices to build a comprehensive system model.

Tightening Cyber Regulations Driving Market Growth

Global mandates such as GDPR (EU), CCPA (U.S.), and the upcoming Cyber Resilience Act (CRA) in Europe are pressuring businesses to upgrade their security infrastructure. This regulatory push is accelerating the adoption of advanced cybersecurity frameworks, especially in BFSI and healthcare sectors.

What is the Role of the Cutting-edge Artificial Intelligence in the Cyber Security Market?

AI-enabled video surveillance systems can identify unusual behavior that suggests threats. The system flags such events to human technicians who can proactively address the threat. A system calls upon pre-programmed stimuli or machine learning (ML) to assess the actual threat. 55% of organizations use AI and data analytics within their security solutions to drive business efficiencies.

Cyber Security Market Opportunities

-

Cybersecurity and Data Privacy: 48% of organizations have already implemented cybersecurity for electronic security systems. 66% have a separate and dedicated cybersecurity leader/team. Innovations spanning materials, manufacturing and digital technologies along with shifts in consumer preferences are pushing forward a demand for commercial security products and services.

-

Cloud Migration: 44% have adopted cloud-based security technology within their organizations. About 17% plan to adopt cloud security technology in the next few months. Renewable energy subsidies and carbon pricing are the catalysts to speed up the market’s growth rate.

- In July 2024, the European Commission announced the investment of €210 million in cybersecurity, digital capacity, and technology under the Digital Europe Program.

- In November 2024, the European Investment Fund announced the utilization of more than €400 million to boost the expansion of the deep technology and cybersecurity sector in Portugal.

Cybersecurity Workforce Gap Spurs Demand for Managed Services

With an estimated 3.5 million unfilled cybersecurity roles globally (source: ISC2 2024), companies are increasingly turning to managed security service providers (MSSPs) to bridge the talent gap and meet compliance needs.

Outlook on the Services Usage by Organizations in 2024 by Securitas Technology

- 86% of organizations use subscription-based electronic security services (e.g. service plans, monitoring and maintenance)

- 85% of organizations are using security technology to predict and prevent threats.

- 41% of organizations make profit from their electronic security systems to drive operational efficiencies and increase cost savings.

- 29% of companies are currently investing in security systems with data analytics driven by AI/machine learning.

Source: https://reports.securitastechnology.com

Cyber Security Market Challenges and Limitations

What are the Potential Concerns associated with Security Solutions?

-

Environmental Concerns: There are eco-friendly and renewable commercial security solutions which are stepped up by the growing awareness of environmental issues and carbon footprint reduction. About 44% of organizations lack internal expert knowledge or a dedicated partner to analyze and structure security data to generate efficiencies.

-

Compliance with Standards: For a promising government security, securing areas and theft to fire compliance and employee health stand out as the challenges. The leading companies like Securitas Technology present solutions on this criterion. Any misconduct by a person or through a system can damage property, harm employees, or steal assets. Hence, there should be an urgency to include intrusion systems.

Industrial Cybersecurity Grows Amid Rising OT Attacks

Cyberattacks on critical infrastructure, such as oil & gas, utilities, and manufacturing, are surging. Gartner forecasts that by 2026, 30% of critical infrastructure organizations will experience a security breach that results in operational disruption.

Cyber Security Market Report Coverage:

| Report Coverage | Details | |

| Market Size in 2024 | USD 268.13 Billion | |

| Market Size in 2025 | USD 301.91 Billion | |

| Market Size in 2030 | USD 546.48 Billion | |

| Market Size in 2032 | USD 692.87 Billion | |

| Market Size by 2034 | USD 878.48 Billion | |

| CAGR 2025 to 2034 | 12.6% | |

| Leading Region in 2024 | North America (36% of Market Share) | |

| Fastest Growing Region | Asia Pacific(2025-2034) | |

| Base Year | 2024 | |

| Forecast Years | 2025 to 2034 | |

| Historical Data | 2021 to 2023 | |

| Market Status | Growing rapidly due to rising threats, digital transformation, and compliance mandates | |

| Segments Covered | Component, Security Type, Solution, Services, Deployment, Organization Size, Application and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Key Players | BAE Systems Plc, Broadcom, Inc., Centrify Corporation, Check Point Software Technology Ltd., Cisco Systems, Inc., FireEye, Inc., Fortinet, Inc., International Business Machines Corporation, Lockheed Martin Corporation, LogRhythm, Inc., McAfee, LLC., Palo Alto Networks, Inc, and Others. | |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

How North America Dominated the Cyber Security Market in 2024?

North America dominated the cybersecurity market in 2024 owing to the adoption of excellent technological solutions. This technological adoption includes the use of thermal perimeter detection, which uses thermal imaging technology and intelligent analytics to help protect outdoor assets and identify threats.

Moreover, there is an adoption of alarm verification that helps to ensure faster police response times and minimize false alarms. Audio or video verification enables the monitoring center specialists to confirm a violation and inform law enforcement. It offers real-time information and a police response.

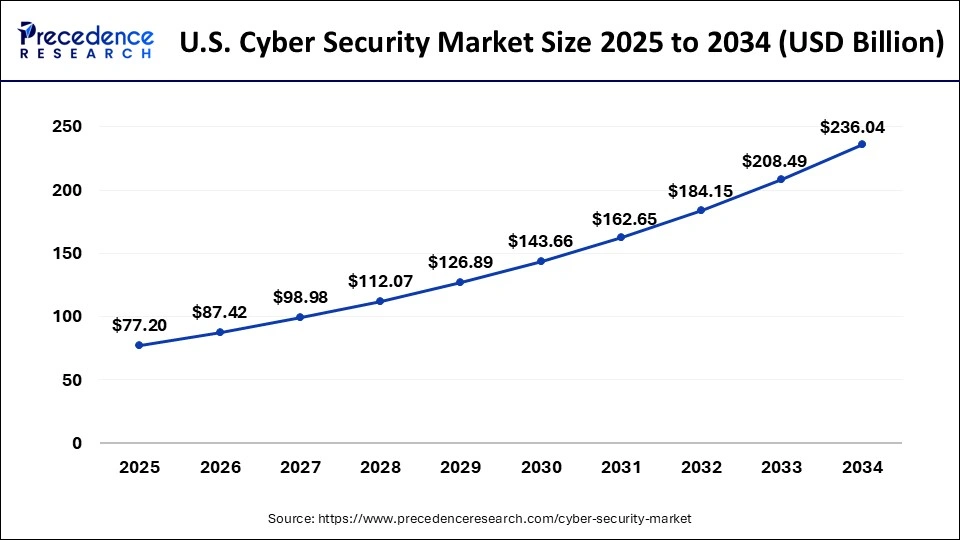

How Big is the U.S. Cyber Security Market Size?

According to Precedence Research, The U.S. cybersecurity market size has been calculated at USD 77.20 billion in 2025 and is estimated to hit approximately USD 236.04 billion by 2034 with a CAGR of 13.20% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

See What’s Inside – Download Sample Pages@ https://www.precedenceresearch.com/sample/3258

How does the U.S. Highlight the Expansive Reach of Security Systems and Solutions?

The various sectors in the U.S. are experiencing numerous applications of security systems, which include commercial buildings, industrial facilities, retail spaces, hospitals, government buildings and banking. The commercial buildings include offices, hotels, and public spaces.

The industrial facilities include factories, warehouses, and manufacturing plants. Retail spaces include shops, shopping malls, and retail outlets. Hospitals include healthcare facilities requiring stringent security measures. Government buildings encompass the offices and premises of government institutions.

What is the Massive Technological Growth of the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the cybersecurity market during the forecast period due to the rapid growth in various technologies like video surveillance systems due to investments in infrastructure and smart city initiatives. The rise in terrorist activities has increased the urge of the government to adopt IP surveillance systems for high-level security in government buildings.

Cloud-based services and cloud management software can drive the demand for access control systems to ensure data confidentiality and authentication. In Asia Pacific, there is a high receptiveness to biometric technology for financial transactions by consumers. This can reduce the dependency on traditional security measures such as PINs, passwords, security questions or various identification cards. Biometrics have been adopted by the healthcare industry and the banking sectors as well.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

How India Steps Forward with the Launch of India’s first commercial High-Performance SoC Chip (System on chip) by Mindgrove Technologies, a Semiconductor Company?

Secure Internet of Things (IoT) is a high-performance microcontroller designed for IoT devices clocked at 700 MHz. The chip is designed to provide programmability, flexibility, security and superior computing power for controlling applications on a wide range of connected smart devices. This chip can control everything from wearables like smartwatches to smart city devices like connected electricity, water and gas meters to connected home devices like smart locks, fans, speakers, as well as EV battery management systems and control systems.

Cyber Security Market Segmentation Analysis

Component Analysis

How Services Segment Dominated the Cyber Security Market in 2024?

The services segment dominated the cyber security market in 2024 owing to the protection of sensitive data and information. These services prevent cyber attacks and breaches, ensure continuity in businesses, and ensure compliance with regulations.

The software segment is expected to grow at the fastest CAGR in the cyber security market during the forecast period due to the protection of business reputation and enhanced productivity. The software assists in remote working, improves data management, supports the IT team, and reduces the financial losses.

Security Type Analysis

What made Infrastructure Protection the Dominant Segment in the Cyber Security Market in 2024?

The infrastructure protection segment dominated the cyber security market in 2024 owing to the enhanced protection against cyber threats and reduced financial costs and losses. It minimizes the downtime, ensures business continuity, reduces legal risks, and ensures compliance with regulations.

The cloud security segment is expected to grow at the fastest CAGR in the cyber security market during the predicted timeframe due to enhanced data protection, scalability, and flexibility. It ensures cost efficiency, disaster recovery, managed services, and expertise.

Solution Analysis

How did the Unified Threat Management (UTM) Segment Dominate the Cyber Security Market in 2024?

The unified threat management (UTM) segment dominated the cyber security market in 2024 owing to the centralized security management and reduced complexity. It presents flexibility, adaptability, cost-effectiveness, and simplified compliance.

The IAM segment is expected to grow at the fastest CAGR in the cyber security market during the forecast period due to enhanced security posture, better user experience, and effective risk management. It supports remote work, allows simplified operations, and offers improved regulatory compliance.

Services Analysis

How Managed Services Segment Dominated the Cyber Security Market in 2024?

The managed services segment dominated the cyber security market in 2024 owing to the access to expert security professionals and proactive threat hunting. They introduce improved incident response, recovery, advanced threat detection, and response.

The professional services segment is expected to grow at the fastest CAGR in the cyber security market during the predicted timeframe due to access to specialized expertise and reduced overhead costs. They present enhanced threat detection, incident response, and regulatory adherence.

Deployment Analysis

What made On-premises the Dominant Segment in the Cyber Security Market in 2024?

The on-premises segment dominated the cyber security market in 2024, owing to the complete control, enhanced security, customization, and compliance. They provide data privacy and less reliance on third parties.

The cloud-based segment is expected to grow at the fastest CAGR in the cyber security market during the forecast period due to automation, continuous updates, and global availability. It allows simplified compliance and scalability, flexibility, and cost-effectiveness.

Organization Size Analysis

How did the Large Enterprises Segment Dominate the Cyber Security Market in 2024?

The large enterprises segment dominated the cyber security market in 2024, owing to the protection of critical assets and maintenance of customer trust and reputation. They achieve regulatory compliance and improve operational efficiency.

The SMEs segment is expected to grow at the fastest CAGR in the cyber security market during the predicted timeframe due to the growth of security-conscious culture. They support compliance and growth through customer trust and reputation.

Application Analysis

How BFSI Segment Dominated the Cyber Security Market in 2024?

The BFSI segment dominated the cyber security market in 2024, owing to the protection of sensitive data of customers and prevention of financial losses. It protects critical infrastructure and enables digital innovation.

The defense/government segment is expected to grow at the fastest CAGR in the cyber security market during the forecast period due to the protection of national security and maintenance of public trust, and safety. It ensures economic stability, growth, and boost international cooperations.

Related Topics You May Find Useful:

- The global generative AI in cybersecurity market size was calculated at USD 2 billion in 2024 and is expected to reach around USD 14.79 billion by 2034. The market is expanding at a solid CAGR of 22.15% over the forecast period 2025 to 2034.

- The global artificial intelligence (AI) in cybersecurity market size is estimated at USD 24.82 billion in 2024 and is anticipated to reach around USD 146.52 billion by 2034, expanding at a CAGR of 19.43% between 2024 and 2034.

- The global cybersecurity services market size was calculated at USD 166.58 billion in 2024 and is predicted to increase from USD 177.27 billion in 2025 to approximately USD 310.35 billion by 2034, expanding at a CAGR of 6.42% from 2025 to 2034.

- The global healthcare cybersecurity market size accounted for USD 27.26 billion in 2024 and is predicted to reach around USD 126.70 billion by 2034, expanding at a CAGR of 16.61% from 2025 to 2034.

- The global cybersecurity mesh market size was estimated at USD 3.32 billion in 2024 and is predicted to increase from USD 3.67 billion in 2025 to approximately USD 9.28 billion by 2034, expanding at a CAGR of 10.83% from 2025 to 2034.

Cyber Security Market Top Companies

- Palo Alto Networks

- Fortinet

- Cisco

- CrowdStrike

- Check Point

- Zscaler

- IBM

- Trend Micro

- McAfee

- Microsoft

- Cloudflare

- Wipro

- Infosys

- Okta

- Quick Heal Technologies

- Rapid7

- Symantec

- Tata Consultancy Services

- Akamai Technologies

- Avast

- Barracuda Networks

- Berettalabs Inc

- CyberArk

- Darktrace

Additional Cyber Security Market Players to Watch

Notable emerging players in the cybersecurity space include SentinelOne, CrowdStrike Holdings, Inc., Elastic N.V., Cybereason, and Tenable, Inc.

What is Going Around the Globe?

- In May 2025, Microsoft announced the launch of an Advancing Regional Cybersecurity (ARC) initiative to create strong cybersecurity in Kenya.

Source: https://blogs.microsoft.com

- In February 2024, Securitas Technology announced two of the four major trends, such as cloud migration and hardware-free architecture, that are shaping the security industry in 2024 and will continue to support diversity in the security industry in its sixth global technology outlook report.

Source: https://www.securitastechnology.com

Cyber Security Market Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Infrastructure Protection

- Data Security

- Others

By Solution

- Unified Threat Management (UTM)

- IDS/IPS

- DLP

- IAM

- SIEM

- DDoS

- Risk & Compliance Management

- Others

By Services

- Professional Services

- Risk and Threat Assessment

- Design, Consulting, and Implementation

- Training & Education

- Support & Maintenance

- Managed Services

By Deployment

- Cloud-based

- On-premises

By Organization Size

- SMEs

- Large Enterprises

By Application

- IT & Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

By Region

North America

- U.S.

- Canada

- Mexico

Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3258

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.