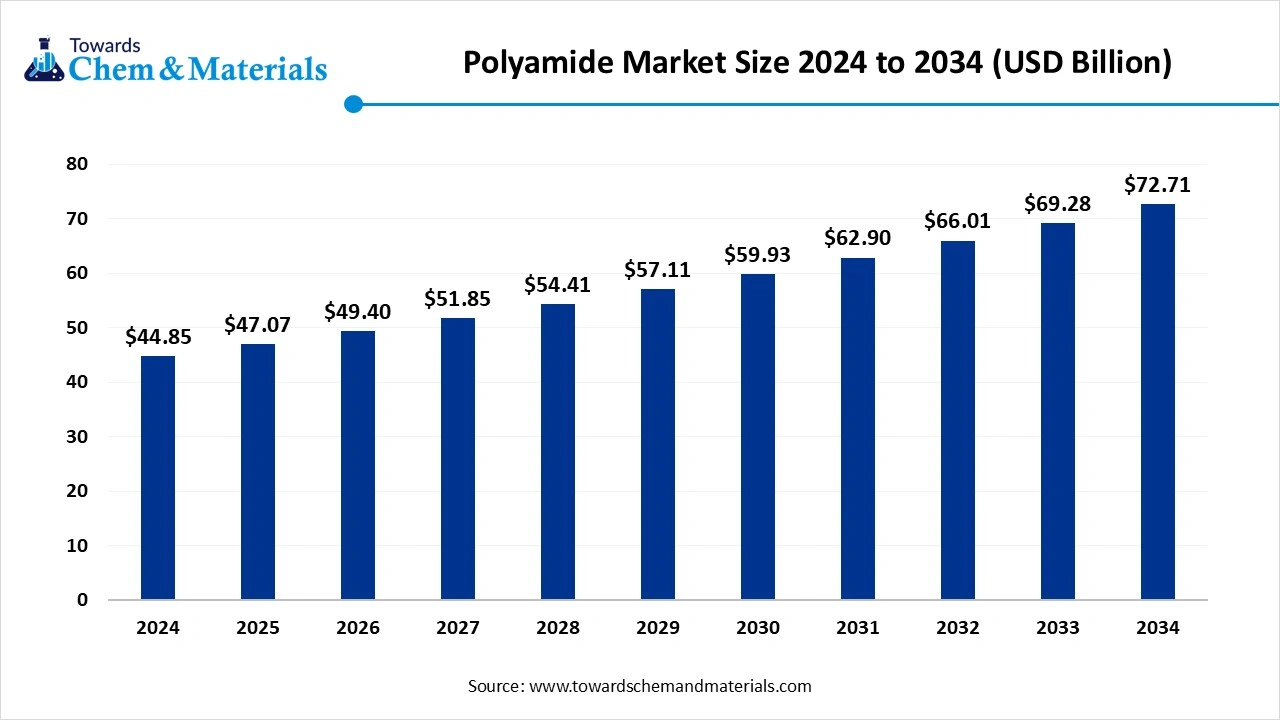

Polyamide Market Size to Surpass USD 72.71 Billion by 2034

According to Towards Chemical and Materials, the global polyamide market size was valued at USD 44.85 billion in 2024 and is expected to surpass around USD 72.71 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.95% over the forecast period from 2025 to 2034.

Ottawa, Aug. 11, 2025 (GLOBE NEWSWIRE) -- The global polyamide market size is accounted for USD 47.07 billion in 2025 and is expected to be worth around USD 72.71 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.95% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5637

The market is experiencing significant growth, driven by increasing demand for lightweight and durable materials in automotive (especially EVs), electronics, textiles, and packaging. Improvements in bio-based and high-performance formulations also benefit its overall positive trajectory.

Polyamides are high-performance polymers whose production is based on the condensation of diamines and dicarboxylic acids. Polyamides are desirable for many applications because of their strength, durability, and resistance to chemicals and abrasion. They encompass an array of products commonly called “nylon,” including nylon 6 and nylon 66. The polydiamide market is very robust and serves markets like automotive, textiles, electrical, and food packaging.

As demand grows for lightweight automotive materials, as global electronics production expands, and as biobased polyamides increasingly find applications, polyamide use is becoming more prevalent. Trends in sustainability and advancements in engineering plastics are influencing anticipated future demand for polyamide products.

Polyamide Market Report Highlights

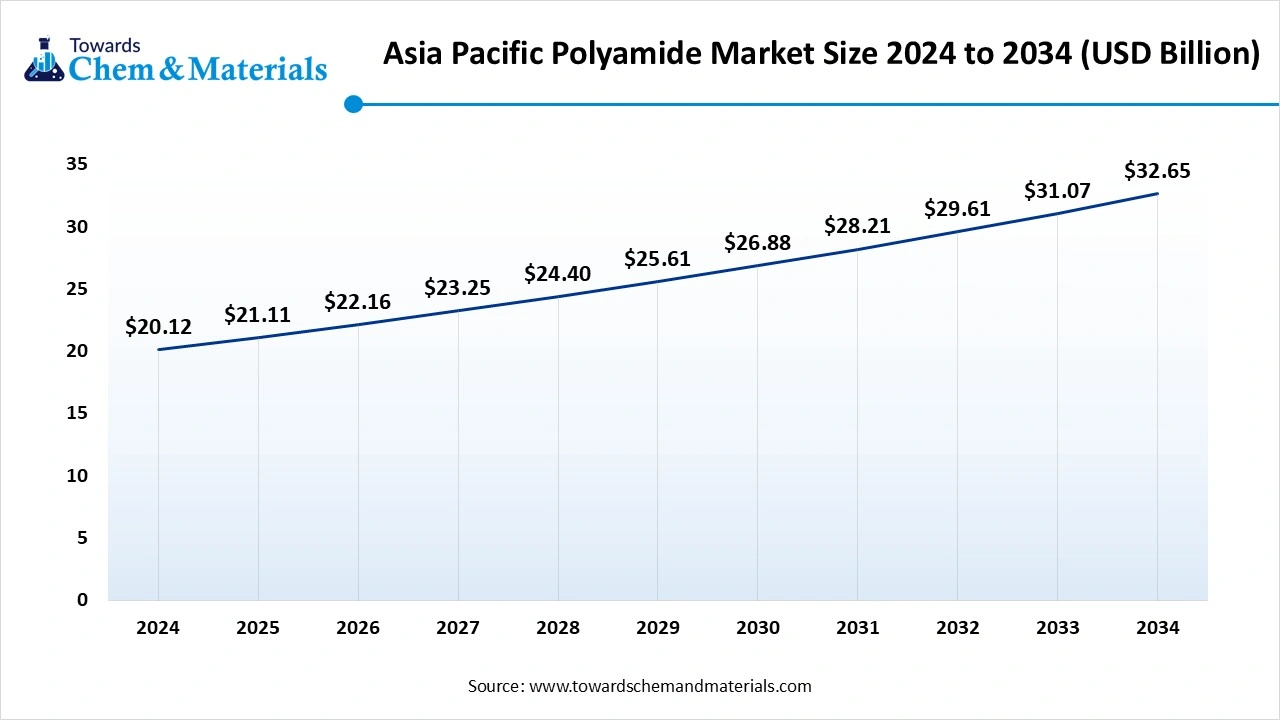

- The Asia Pacific polyamide market size was estimated at USD 20.12 billion in 2024 and is projected to reach USD 32.65 billion by 2034, growing at a CAGR of 4.96% from 2025 to 2034.

- Asia Pacific polyamide market dominated and accounted for the largest revenue share of over 44.85% in 2024 and is anticipated to grow at the fastest CAGR of 5.15% over the forecast period.

- By product, the polyamide 6 product segment recorded the largest market revenue share of over 52.85% in 2024.

- By product, the Bio-based polyamide is projected to grow at the fastest CAGR of 11.2% during the forecast period.

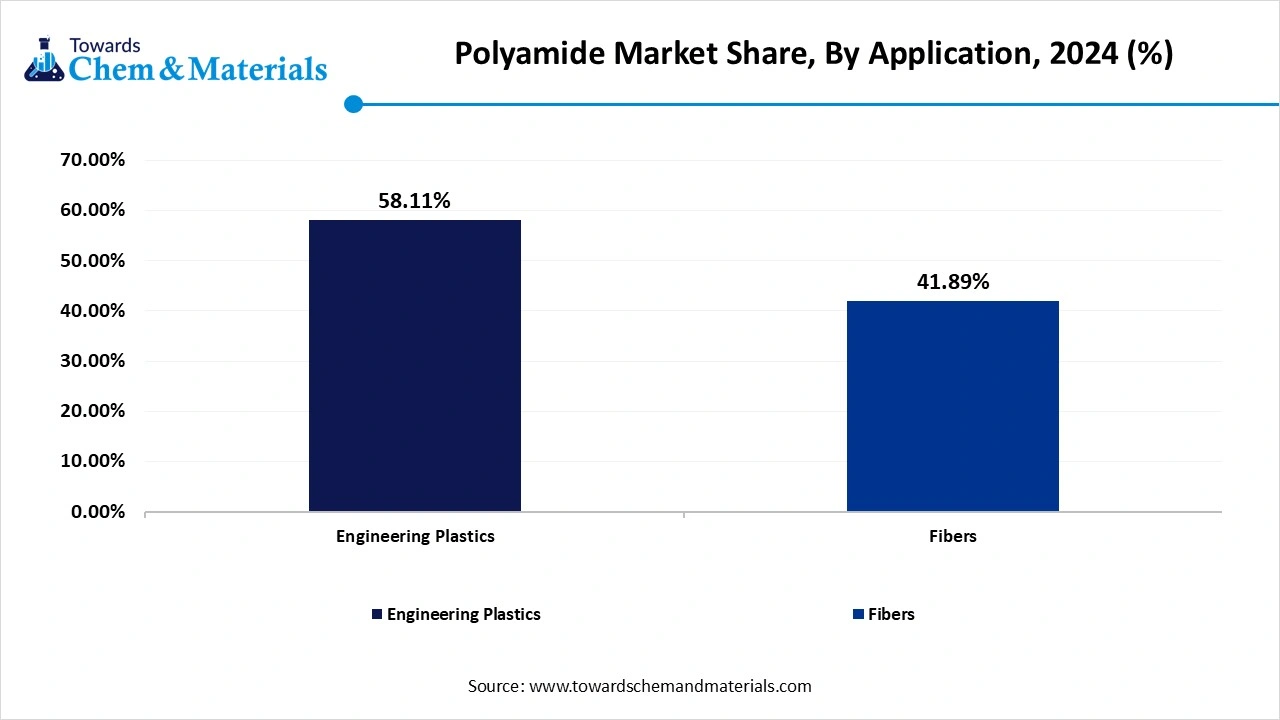

- By application, the engineering plastics segment recorded the largest market share of over 58.11% in 2024.

- By application, the fibers segment is anticipated to experience the highest CAGR of 4.75% during the forecast period.

Performance Profile of Polyamide Market

Polyamides have a good balance of properties. They exhibit high temperature and electrical resistance. Thanks to their crystalline structure, they also show excellent chemical resistance. They have very good barrier and mechanical properties. These materials can easily be flame retarded.

Here are the main reasons why polyamides (nylons) are considered high-performance plastics:

- High strength and toughness – Polyamides are chosen for their excellent mechanical properties. They can withstand high impact and stress. High strength and durability are common requirements. View PA grades with high toughness.

- Thermal stability – Polyamides retain strength and stiffness at elevated temperatures. Hence, they are used in applications where thermal stability is required.

- Chemical resistance – In applications like gears and bearings, resistance to wearing, grease, and oil is critical. So, specialized polyamides are developed to resist chemical damage.

- Friction – A low coefficient of friction is required for bearing, gears, and other sliding parts.

- Lightweight – In many applications, there is a desire for lightweighting so plastic formulators may specify density as a requirement.

- Electrical insulation – The insulating properties make polyamides useful for electrical components. These applications include plugs, sockets, coil bobbins, and many more.

- Moisture absorption – The moisture-absorbing properties of polyamides make them suitable for tubing and reservoirs.

- Heat stability – Polyamides offer heat stability at temperatures ranging from 100°C exceeding 200°C. In some cases, the temperatures also exceed 500°C. Heat stabilizers can be added to improve the dimensional stability of polyamides.

- Processability – Polyamide grades show good processability. They can be processed using injection molding, extrusion, 3D printing, and many other processing techniques.

-

Incorporating reinforcements like glass, carbon fiber, carbon black, aramid fiber, minerals, PTFE, and molybdenum sulfide may alter the mechanical properties of polyamides.

- Glass fiber – When polyamides are added with glass fillers their stiffness can compete with metals. Hence, they are considered in metal replacement projects.

- Carbon fiber – Adding carbon fiber may increase the strength, rigidity and dimensional stability of polyamides.

- Carbon black – Carbon black fillers improve resistance to wear, UV, and electrical conductivity of polyamides.

- Aramid fiber – Reinforcing with aramid fiber contributes to extreme tensile strength and heat resistance limiting creep.

- Mineral fillers – Talc and calcium carbonate increase the stiffness and heat deflection temperatures of polyamides. This reduces the cost but tend to decrease strength and toughness.

- PTFE – Provide solid lubricant properties and low coefficient of friction for bearings, gears, and other sliding applications while enhancing chemical resistance.

-

MOS2 – Similar to PTFE, molybdenum disulfide powder provides the same performance. Additionally, they are self-lubricating in parts like bushings.

These properties position them above widespread commodity plastics for advanced engineering applications. Their unique property combination makes them exemplary high-performance thermoplastics.

You can select a single property or a combination of properties to achieve the desired end application.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5637

Polyamide Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 47.07 Billion |

| Revenue forecast in 2034 | USD 72.71 Billion |

| Growth rate | CAGR of 4.95% from 2025 to 2034 |

| Historical data | 2019 - 2024 |

| Forecast period | 2025 - 2034 |

| Segments covered | Product, application, region |

| Key companies profiled | BASF; Evonik AG; Arkema; Solvay; Domo Chemicals; DSM-Firmenich; Lanxess; DuPont; TORAY INDUSTRIES, INC.; Ascend Performance Materials; Koch IP Holdings, LLC.; Advansix; Celanese Corporation; Huntsman International LLC; Mitsui Chemicals |

Elevate your Chemical strategy with Towards Chemical and Materials. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardschemandmaterials.com/schedule-meeting

What are the Major Trends in the Polyamide Market?

- Commitment to Bio-based polyamides- As businesses commonly look for ways to be more sustainable, bio-based polyamides produced from renewable sources are gaining traction across the automotive and textile industry due to their lower carbon footprint as well as meeting eco-friendly regulations.

- Using lighter materials in automobiles- Polyamides have become a more favorable alternative when used in place of metals. Studies have shown, if automakers are able to use more polyamides, it will help reduce vehicle weight, improve fuel efficiency/clearly meet of emission regulations, when so desired, while not sacrificing structural performance.

- Growth in electronics applications- The electronics sector is investing in more applications of polyamide components, utilizing its thermal and electrical insulation properties as well as its durability. With the ongoing trends of miniaturization of devices and development of electrical vehicles, that is almost inevitable polyamide will find its place in the spectrum of applications.

- High performance polyamides- As more advances are being made with regard to reinforced polyamides and its improved heat & chemical resistance, expanded opportunities exist in the aerospace and industrial equipment space, where continued use of polyamides would be desirable to ensure long-term durability.

Polyamide Market Dynamics

Growth Factor

Is Global Light weighting Mandates Stoking Polyamide Demand in Automotive industries?

A strong global growth indicator for the polyamide market is the growing uptake of vehicle light weighting, a response to fuel efficiency and emissions restrictions put in place by major world governments and regional regulators beginning in 2023. These authorities, such as the European Union, have established strict CO₂ limits, including the Euro 6d emissions standard (≤ 95 g/km for passenger cars), forcing OEMs to decrease vehicle weight.

Fenders (the part of an automobile) in a conductive polyphenylene oxide/polyamide thermoplastic blend (known as NORYL GTX resin) can result in a significant weight reduction compared to steel; ultimately supporting compliance with lucrative regulatory mandates and increasing range.

This stimulus and momentum of global regulation are inciting greater polyamide consumption in both electric and conventional powertrains.

Market Opportunity

Could Eco-Friendly Nylon Fuel the Next Wave of Growth in the Polyamide Market?

The unprecedented demand for sustainable materials has created a unique opportunity in the polyamide market: the emergence of bio-based and recycled nylon solutions. In October 2024, RadiciGroup launched new line of bio-based engineering polymers at Fakuma. They have launched several experimental grades including Radilon P (PA 56) with about 40% bio-based content that features high crystallinity and moisture absorption and melting temperature of 252°C, Radilon TT (PA 1012), and 100% bio-based Radilon PX (PA 510).

Fashion brands, such as Stella McCartney, are also utilizing recycled nylon in their premium collection, indicating an industry trend. Applications in automotive, electronics, and other sectors are embracing eco-friendly polyamides to keep pace with evolving regulatory and consumer demand. This shift, towards sustainable innovation, gives manufacturers an opportunity to take advantage of green alternatives, but also gain a competitive advantage within the global polyamide market.

Limitations and Challenges in the Polyamide Market

- Environmental Issues- Polyamide production is high in energy usage and depends on petroleum-based feedstocks, resulting in high carbon emissions. As sustainability regulations increase and awareness of the environment, there is more pressure on manufacturers to find more environmentally friendly alternatives to polyamides, which could restrict traditional demand for polyamides.

- Raw Material Price Uncertainty- The cost of important raw materials like crude oil and caprolactam is wildly fluctuating due to global supply chain gridlock and geopolitical unrest. These price variances (or uncertainty) impacts potentially profitability and discourages long-term investment in polyamides.

- Competition from Alternatives- New bio-based polymers and other lightweight, cheap materials are replacing polyamides in the automotive, textiles, and packaging applications. The increase in competition is holding back growth of polyamide markets in several application categories.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Why is the Polyamide Market Dominated by Asia Pacific?

The Asia Pacific polyamide market is expected to increase from USD 21.11 billion in 2025 to USD 32.65 billion by 2034, growing at a CAGR of 4.96% throughout the forecast period from 2025 to 2034.

Asia Pacific dominated the market in 2024, with several market dynamics at play, particularly due to the strong, viable manufacturing base, growing automotive production, and the increasing size of electrical and electronics industries. Furthermore, the region also has an intrinsic advantage from the availability of cheap raw materials as well as the large-scale infrastructure development, which is directly driving the demand for high performance engineering plastics, like polyamide. The demand for light yet durable materials in automotive and industrial applications have also strengthened the Asia Pacific's dominance together with growing polymer research and development investments, and increasing sustainable and bio-based polyamides adoption across various end-use applications.

Market Trends in China

China is an important contributor to the Asia Pacific's dominance of the polyamide market, as it is a massive industrial base and a very active player on the global trade market. According to The Observatory of Economic Complexity (OEC), 2024 China exported US$2.03 billion dollars’ worth of polyamides, 294th out of 1211 such categories of specific products. Major export destinations included India with $405 million, South Korea with $401 million, Vietnam with $173 million, Japan with $158 million, and Thailand with $126 million among several others.

The statistics on the polyamide exports demonstrates the capabilities of the industrial manufacturing in China, and strategic role it plays in supplying polyamides to the automotive, electronics, and textile industries across Asia, thereby reinforcing its dominant position in the regional market.

Why North America showing up as the Fastest Growing Region in Polyamide Market?

North America expects the fastest growth in the polyamide market during forecast period, driven by growing interest in high-performance polymers for use in automobile, aerospace and healthcare applications. The region's emphasis on lightweight, durable materials has been fueling rising use of polyamides, such as in electric vehicles, fuel systems, and precision engineering industries. Additionally, North America has strong research and development (R&D) potential and has an abundance of polymer manufacturers, which are investing heavily for innovative formulations and sustainable alternatives, pushing the momentum in the sector.

Market Trends in the U.S.

The United States is a combination of industrial strength and trade prowess on a global scale. According to The Observatory of Economic Complexity (OEC), in May 2025, the U.S. exported $189 million of polyamides and imported $55.3 million (a positive trade balance of $133 million). Polyamides ranked 125th out of 1,227 of the most exported products in the country. Leading export countries for the U.S. polyamides included Mexico ($63.3M), Belgium ($15.5M), Canada ($15.2M), Japan ($11.1M), and Thailand ($10.4M).

This trade analysis demonstrates the North American manufacturing capacity and supremacy in supplying quality-grade polyamides. Coupled with high domestic demand and advancements in technology, the U.S. is on a trajectory of becoming a key innovator and exporter of polyamide polyether.

Polyamide Market Segmentation

Product Insights

Why Polyamide 6 Is The Dominant Product Type Segment?

The polyamide 6 segment accounted for the largest revenue share in 2024 because of the properties that play a vital role in the mechanical strength, and chemical stability, and abrasion resistance of polyamide 6. This such as great properties makes it a suitable use in applications that involve the automotive, consumer goods, and electrical industries sometimes with extreme requirements. Because of its exceptional properties, inexpensive, the ability to readily replace metal in structural applications, and because it is easily processed, polyamide 6 is the most widely used type of polyamide and is likely to continue to dominate.

The bio-based polyamide segment is expected to experience the fastest growth during the 2025 to 2034. This is primarily because of an increase in concern surrounding the environment, a shift towards more sustainable materials, and regulatory support in promoting low-emission options. For manufacturers that are eco-conscious, bio-based polyamides can yield similar properties to traditional polyamides while greatly reducing the carbon footprint.

Application Insights

Which Application Segment Dominates the Polyamide Market?

The engineering plastics segment led the market in 2024, registering the largest revenue share. This segment will hold the largest market share due to the increasing need for high-performance materials in multiple end-use industries, including automotive, electronics, and industrial equipment. Engineering plastics also have excellent mechanical properties, durability, and heat resistance, providing a substitute option to metals for structural components. The use of engineering plastics allows for weight reduction, fuel efficiency, and cost savings in manufacturing processes.

The fibers segment is projected to grow at highest CAGR during the forecast period. Growth in this segment is due to demand for lightweight, strong, and versatile fibers for textiles, industrial yarns, carpets, and sportswear. The segment is supported by the transition towards sustainable and high-performance fabrics, contributing to the rapid growth of the fibers segment.

More Insights in Towards Chemical and Materials:

- Paraxylene Market : The global paraxylene market volume was reached at 62.60 million Tons in 2024 and is expected to hit around 96.40 million Tons by 2034, exhibiting a compound annual growth rate (CAGR) of 4.59% during the forecast period 2025 to 2034.

- Polyhydroxyalkanoates Films Market : The global polyhydroxyalkanoates films market size accounted for USD 11.69 billion in 2024, grew to USD 12.83 billion in 2025, and is expected to be worth around USD 29.64 billion by 2034, poised to grow at a CAGR of 9.75% between 2025 and 2034.

- Marble Market : The global marble market size was valued at USD 70.45 billion in 2024 and is estimated to reach around USD 111.52 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.70% during the forecast period 2025 to 2034.

- Helium Market : The global helium market size reached USD 4.25 billion in 2024 and is projected to hit around USD 8.17 billion by 2034, expanding at a CAGR of 6.75% during the forecast period from 2025 to 2034.

- AI in Chemicals Market : The global artificial intelligence in chemicals market size was valued at USD 2.19 billion in 2024 and is expected to reach around USD 28.74 billion by 2034, growing at a CAGR of 29.36% from 2025 to 2034.

- Poly (Butylene Adipate-Co-Terephthalate) Market : The global poly (butylene adipate-co-terephthalate) market size accounted for USD 1.85 billion in 2024 and is predicted to increase from USD 2.02 billion in 2025 to approximately USD 4.42 billion by 2034, expanding at a CAGR of 9.11% from 2025 to 2034.

- Specialty Fuel Additives Market : The global specialty fuel additives market size was estimated at USD 11.27 billion in 2024 and is predicted to increase from USD 12.07 billion in 2025 to approximately USD 22.4 billion by 2034, expanding at a CAGR of 7.11% from 2025 to 2034.

- Ethylene Propylene Diene Monomer Market : The global ethylene propylene diene monomer market size was estimated at USD 5.17 billion in 2024 and is predicted to increase from USD 5.46 billion in 2025 to approximately USD 8.87 billion by 2034, expanding at a CAGR of 5.55% from 2025 to 2034.

- U.S. Specialty Oleochemicals Market : U.S. specialty oleochemicals market size accounted for USD 4.23 billion in 2024 and is predicted to increase from USD 4.57 billion in 2025 to approximately USD 9.23 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Asia Pacific Bioplastics Market : The Asia Pacific bioplastics market volume was reached at 2.51 million tons in 2024 and is expected to be worth around 11.13 million tons by 2034, growing at a compound annual growth rate (CAGR) of 16.07% over the forecast period 2025 to 2034.

Polyamide Market Top Key Companies:

- Evonik AG

- Solvay

- DSM-Firmenich

- DuPont

- BASF

- Arkema

- Domo Chemicals

- Lanxess

- TORAY INDUSTRIES, INC.

- Koch IP Holdings, LLC.

- Celanese Corporation

- Ascend Performance Materials

- Advansix

- Huntsman International LLC

- Advansix

- Mitsui Chemicals

What is Going Around the Globe?

- In July 2025, Arkema announced plans to construct a new Rilsan® Clear transparent polyamide production site in Singapore. The unit will be commissioned in early 2026, and eventually expand global production of bio-based transparent polyamides by 3x, to satisfy the increasing demand for use in the optics and electronics industries.

- In March 2025, BASF launched the first commercial scale plant for recycled polyamide 6 (Loopamid®) in Shanghai, China. The Shanghai facility uses textile feedstock waste, and further support BASF's goals of the circular economy, especially for automotive and electronics applicant use.

- In July 2024, Syensqo launched five new polyamide grades in the Omnix® ECHO series, with recycled content attributed at up to 98%! The materials are supplied as a 75-80% recycled content on the materials that meet the high-performance standards needed in the marketplace . The series includes the first food-contact approved recycled polyamides for use in critical industrial and consumer goods applications.

- In July 2024, LyondellBasell announced the launch of Schulamid® ET100, a new polyamide compound targeted to automotive applications. Designed specifically for EV and ICE vehicles, the new material has impressive mechanical properties and dimensional stability, and provides the opportunity of lower-weight components for applications such as window frames and other interior structural parts.

Polyamide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polyamide Market

By Product

- Polyamide 6

- Bio-Based Polyamide

- Polyamide 66

- Specialty Polyamide

By Application

- Engineering Plastics

- Electricals & Electronics

- Packaging

- Automotive

- Consumer Goods & Appliances

- Fibers

- Textile

- Carpet

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5637

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.