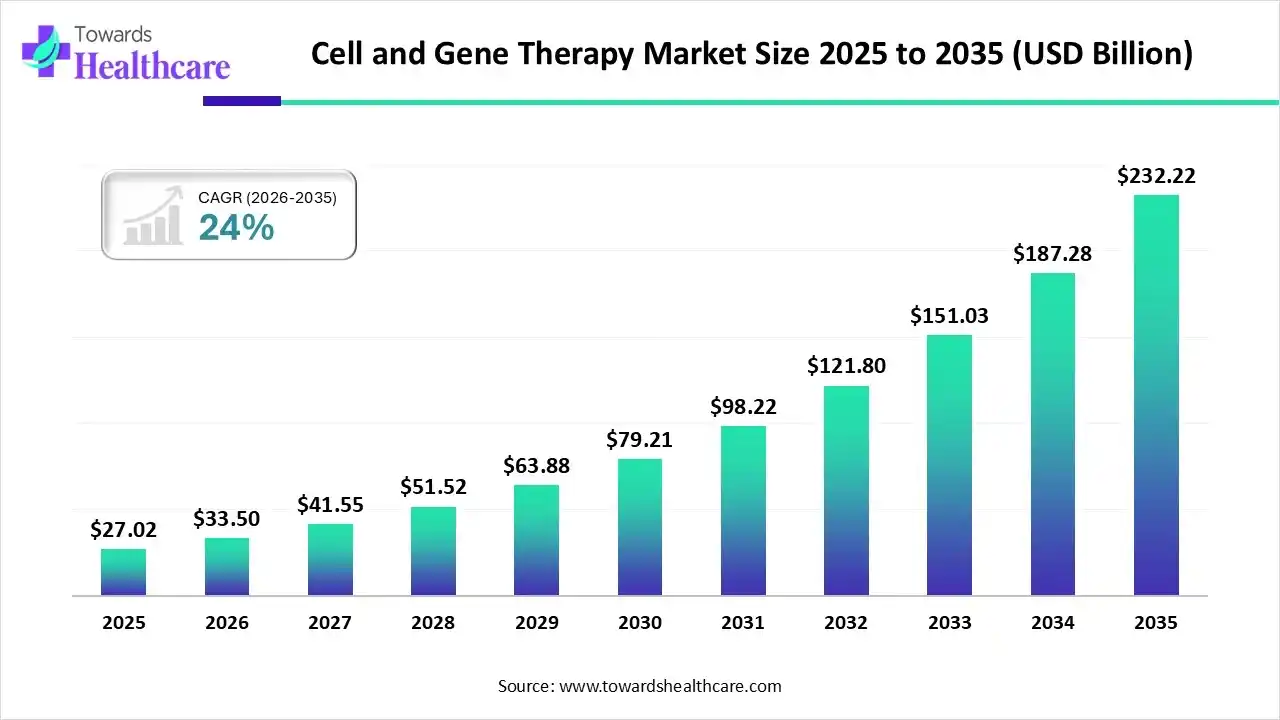

Cell and Gene Therapy Market Size to Worth USD 232.22 Billion, Rising at 24% CAGR by 2035

The global cell and gene therapy market size is valued at USD 27.02 billion in 2025 and is predicted to hit around USD 232.22 billion by 2035, rising at a 24% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 09, 2025 (GLOBE NEWSWIRE) -- The global cell and gene therapy market size is calculated at USD 33.5 billion in 2026 and is expected to reach around USD 232.22 billion by 2035, growing at a CAGR of 24% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5052

Globally rising burden of a variety of chronic and rare diseases, as well as cancer instances are promoting the comprehensive development of the cell and gene therapies. Alongside, numerous key players are securing funding in the progression of novelty, feasibility in clinical trials, and expansion of their facilities. Specifically, the ASAP countries are accelerating innovations in these therapies through the streamlined and automated manufacturing processes.

Essential Highlights

- Cell and gene therapy industry poised to reach USD 33.5 billion by 2026.

- Forecasted to grow to USD 232.22 billion by 2035.

- Expected to maintain a CAGR of 24% from 2026 to 2035.

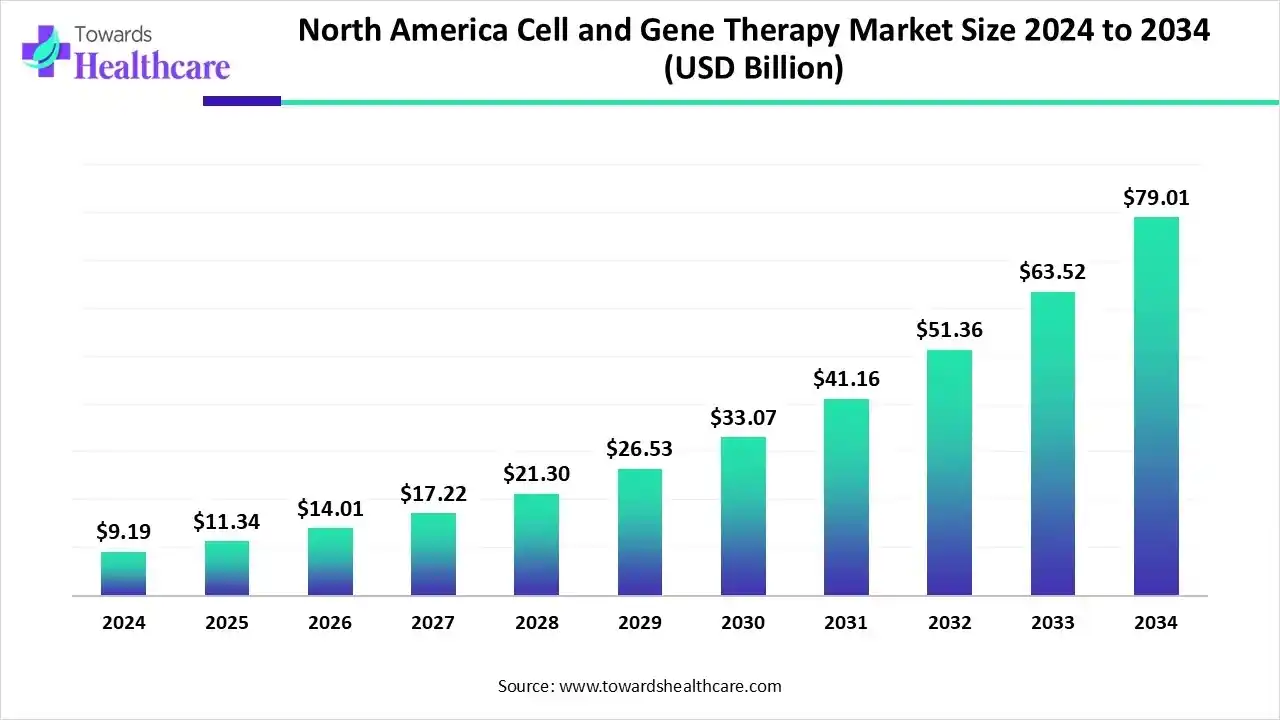

- The North American cell and gene therapy market is set to grow from US$ 11.34 billion in 2025 to US$ 79.01 billion by 2034 at a CAGR of 24.01%.

- Europe’s cell and gene therapy market is $ 2.74 billion in 2024, $ 7.17 billion in 2025, and $ 48.96 billion by 2034, growing at 23.9% CAGR.

- APAC Cell and Gene Therapy Market to Grow from USD 4.59 billion in 2024 to USD 39.62 billion by 2034 at 24.04% CAGR

- The Middle East and Africa cell and gene therapy market is set to grow from USD 1.41 billion in 2025 to USD 9.75 billion by 2034 at a CAGR of 23.85%.

- The Latin American cell and gene therapy market is set to grow from US$ 1.15 billion in 2024 to nearly US$ 10.19 billion by 2034 at a 24.40% CAGR.

- It's expected to be worth billions of dollars in the coming years due to advancements in personalized medicine.

- Gene editing tools like CRISPR are revolutionizing treatment approaches.

- CAR-T cell therapy is proving highly effective for cancers like leukemia and lymphoma.

- Originally focused on rare genetic disorders and cancer, now expanding into neurological, cardiovascular, and autoimmune diseases.

- Growing interest in using gene therapy for conditions like sickle cell disease, blindness, and muscular dystrophy.

- Governments and regulatory bodies (FDA, EMA) are fast-tracking approvals for promising therapies.

- Big pharma and biotech companies are heavily investing, making this sector highly competitive.

- With more clinical trials, technological advancements, and investments, the future looks promising.

Executive Summary

The global cell & gene therapy market is fueled by a growing number of infectious disease and cancer cases, as well as enhancing technological advances, like gene editing tools. Many vital players are implementing robust clinical trials with a focus on personalized approaches, novel drug delivery systems, and faster regulatory approvals. However, the extensive companies are increasingly adopting AI and machine learning algorithms to analyse vast biological datasets, and are also exploring automation to streamline the production process.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Enhancements in Latest Developments: What are the Robust Advances in Cell & Gene Therapy?

2025 is the era which experiencing an accelerated rise in the prevalence of diverse chronic diseases, thus researchers are stepping into novelty in the more effective cell and gene therapies. Nowadays, the market is emphasizing the development of "off-the-shelf" allogeneic therapies, which use donor cells or iPSCs for increasing accessibility and optimizing delivery systems.

In the case of newer drug delivery solutions, scientists are studying non-viral delivery systems like lipid nanoparticles (LNPs). Alongside, many manufacturers are focusing on improving their processes through the wider adoption of automation and AI to simplify cell extraction, genetic modification, and purification, while lowering the risk of contamination.

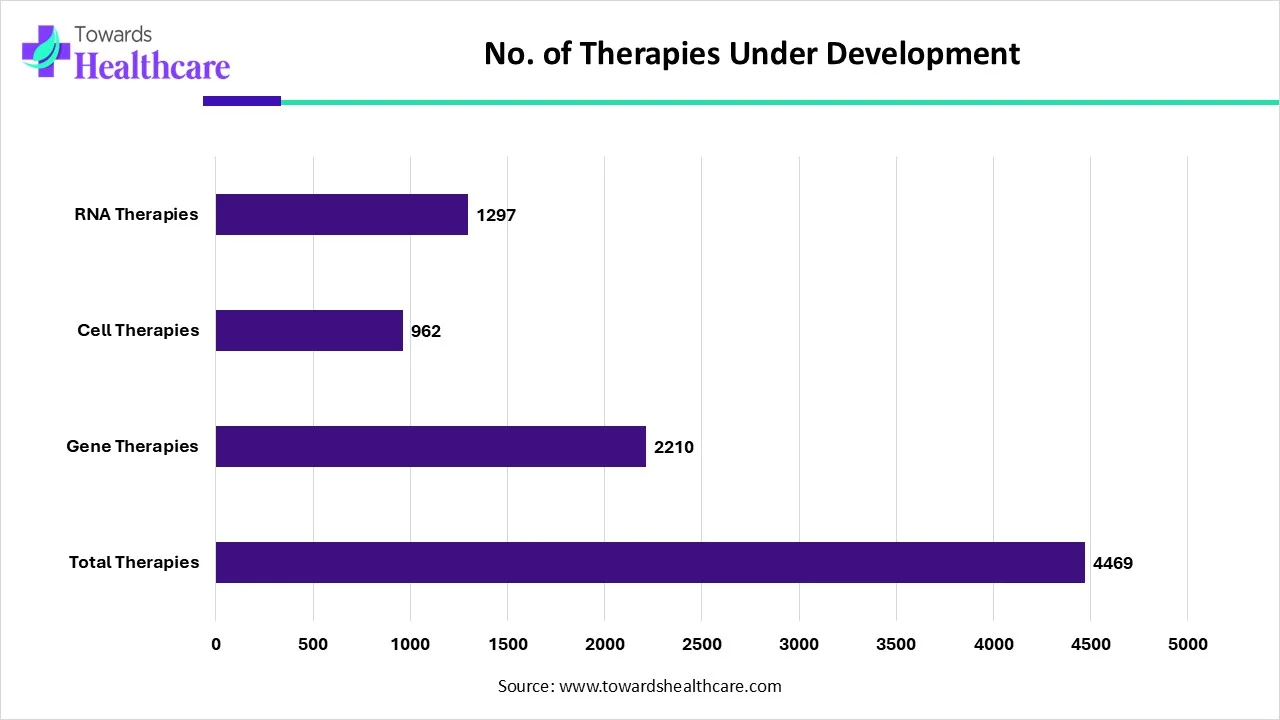

Number of Therapies Under Development in 2025:

How is AI Governing the Cell & Gene Therapy Market?

A prominent catalyst for the use of AI is its increased robustness in drug discovery and design, specifically large language models (LLMs) and machine learning (ML) algorithms for analysing large volumes of biological datasets to determine therapeutic targets and design gene-editing tools.

For instance, in September 2025, at Stanford Medicine, they developed CRISPR-GPT, an LLM that accelerates gene-editing experiments and expands access to the technology for a broader range of scientists. However, the FDA is also promoting the greater AI applications, like AI-assisted adaptive and Bayesian designs for clinical trials, mainly for rare conditions.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Extensive Investments in AI and Technologies by Major Players

- In November 2025, Cassidy Bio, a biotechnology company raised US$8 million in seed funding to establish an AI-enabled genomic platform for gene editing therapies.

- In October 2025, AstraZeneca signed up to $555 million AI deal with Algen to evolve therapies using its AI-powered gene-editing platform.

- In August 2025, Somite.ai received a planned investment from AMD Ventures to escalate foundation models for cell therapy.

- In March 2025, Hologen AI, Artificial intelligence company committed up to $430 million as part of a multifaceted agreement to support take MeiraGTx’s Parkinson’s disease gene therapy across the market.

- In March 2025, Epicrispr Biotechnologies secured $68 Million Series B to begin clinical trial for first-in-class disease-modifying epigenetic neuromuscular therapy for FSHD.

Market Snapshots - Regional Distribution Table and key highlights of regions

- North America registered dominance in the market in 2024.

- The U.S. led the market by capturing the largest revenue share of the market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the studied years.

- China is anticipated to grow at a rapid CAGR during the forecast period.

- Middle East & Africa held a notable share in 2024 and is expected to grow significantly in the coming years.

- Africa is expected to grow at a lucrative CAGR during 2025-2034.

Regional Insights

How did North America Dominate the Market in 2024?

The North American cell and gene therapy market was valued at US$ 1.2 billion in 2024, increased to US$ 1.3 billion in 2025, and is projected to reach approximately US$ 4.47 billion by 2034, growing at a CAGR of 14.05% from 2025 to 2034.

By capturing a major share, North America led the cell & gene therapy market in 2024. This is mainly empowered by the presence of R&D infrastructure, raised investments, collaborations, and faster approvals for novel products. Alongside, firms are providing funding for startups and innovative access models for patients. Whereas the U.S. held the dominating share of this regional market.

The U.S. organisations are spurring new stem cell therapies, with various programs moving through structured Phase I–III trials, led by designations, including Regenerative Medicine Advanced Therapy (RMAT). In April 2025, Rgenta Therapeutics, a clinical-stage biotechnology company, presented preclinical data on its proprietary RSwitch technology, which allows the fine-tuning of transgene levels in gene and cell therapy applications at the ASGCT 28th Annual Meeting in New Orleans, LA.

A Surge in Domestic Approvals & Trials is Driving the Asia Pacific

In the future, the Asia Pacific will expand rapidly in the cell & gene therapy market. This expansion will be driven by ongoing clinical trials for newer therapies, such as Rznomics from South Korea is performing trials for gene therapies to target glioblastoma and strategies for hepatocellular carcinoma and autosomal dominant retinitis pigmentosa.

Whereas China is predicted to expand at a rapid CAGR, with accelerating domestic CGT approvals. In 2024, China approved Zevorcabtagene Autoleucel (ZEVOR-CEL) for multiple myeloma, as well as BBM-H901, a gene therapy for hemophilia B, approved in April 2025.

Immersive Government Strategy Supports MEA

With a lucrative growth, the cell & gene therapy market in MEA has been focusing on government initiatives, such as Saudi Arabia's Vision 2030 and National Biotechnology Strategy to raise the country's reach as a regional biotech hub by investing in infrastructure, talent, and R&D. However, Africa has leveraged a new initiative by the Africa Health Organisation (AHO) in April 2025, called innovative gene-editing therapy exagamglogene autotemcel (exa-cel) for eligible patients in Africa and the Diaspora to treat severe sickle cell disease (SCD).

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Number of Cancer Cases in Different Countries

| Country | No. of Cancer Cases (2024) |

| US | 1,533,055 |

| India | 2,001,140 |

| China | 3,246,625 |

| Japan | 979,300 |

Cell & Gene Therapy Market: Value Chain Analysis

Note: This part shall go with an infographic

1. R&D

This emphasises the use of genetic material, gene editing tools, and boosting discovery with AI, evolving new therapeutic vectors (e.g., AAV, lentiviruses), and overcoming limitations in scaling up complex manufacturing processes.

Key Players: Spark Therapeutics, Intellia Therapeutics, Bluebird Bio, etc.

2. Clinical Trials & Regulatory Approvals

Trials comprise a patient referral, eligibility screening, and informed consent, and then cell collection, a conditioning process to prepare the body, and then infusion of the modified cells, and finally follow the regulatory approvals process of the US FDA, EMA, or other bodies.

Key Players: IRCCS San Raffaele, Donald B. Kohn, M.D., David Williams, etc.

3. Patient Support & Services

They receive through insurance, financial assistance, patient education, care coordination, and psychosocial support.

Key Players: Cencora, Claritas Rx, Allucent, etc.

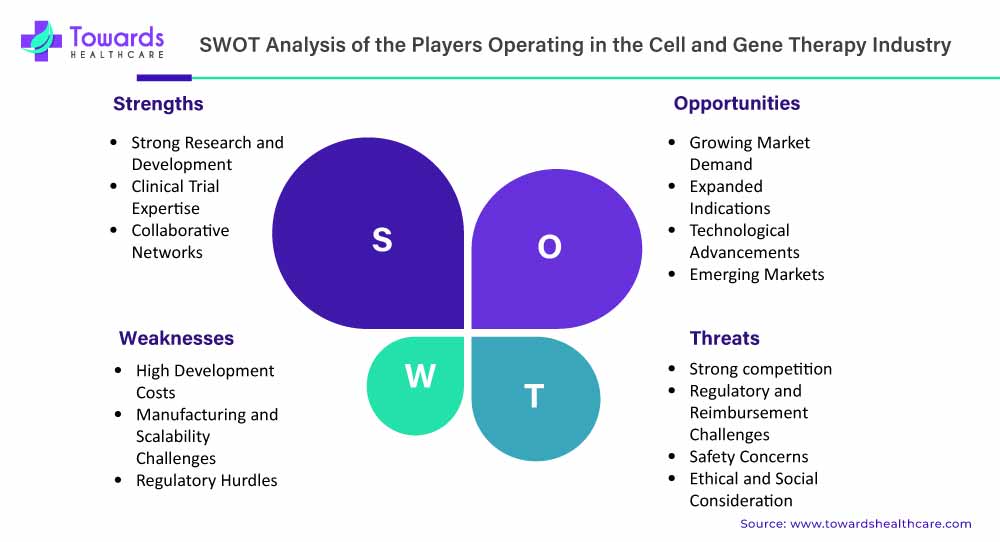

SWOT Analysis

Strength

- One of the significant strengths, gene therapies are immensely efficacious in curing different genetic diseases, such as sickle cell disease.

- Also, the advanced cell and gene therapies have potential in revolutionizing cancer treatments to develop precision CAR-T therapy by utilizing patients’ own immune cells, with enhanced survival rates.

- Their emerging developments are involved in the treatment of inherited eye disorders, with other neurological concerns and boosted drug delivery systems.

- Also, the expanding collaborations among academic institutions, research organizations, and other industry companies are allowing access to expertise, resources, and patient populations, encouraging innovations.

Weakness

- A major restraint is the limitation in the collection, modification, and delivery of patient-specific cells, which may take weeks, resulting in increased manual work & expenditure of the overall process.

- Particularly, cell therapies have challenges in treating solid tumors, due to the immunosuppressive nature of solid tumors and physical barriers.

Opportunity

- A revolutionary opportunity is the progression of innovative next-generation gene editing tools, including prime and base editing, to facilitate accelerated precision and minimal off-target effects.

- For robust production, players can increasingly utilise automation and decentralised solutions to support streamlining the process, with lowered spending, and raised treatments accessibility to the patients.

- Additionally, the market will focus on groundbreaking reimbursement models, like outcome-based contracts, to make possible one-time treatments financially feasible for healthcare systems and patients.

Threats

- It is more difficult to explore the highly tailored nature of cell and gene therapy, which makes it inherently complex in scaling up from lab to large-scale production.

- Another is the need for maintenance of quality control during the manufacturing of living cells, as they carry an increased risk of contamination and complexities in quality and efficacy.

Latest Updates of Key Players in the Cell & Gene Therapy Market

| Company | Headquarters | Latest Update |

|

Alnylam Pharmaceutical Inc. |

Cambridge, Massachusetts. |

Along with Roche, it will advance zilebesiran into the global Phase 3 ZENITH CVOT, which is predicted to initiate by year-end 2025. |

|

Amgen Inc. |

Thousand Oaks, California, United States. |

Announced a new interim results from the global Phase 3 DeLLphi-304 trial showing IMDELLTRA (tarlatamab-dlle) lowered the risk of death by 40%. |

|

Biogen Inc. |

Cambridge, Massachusetts. |

Collaborated with Stoke Therapeutics for the progression and commercialization of zorevunersen, used in the treatment of Dravet syndrome. |

|

Pfizer Inc. |

New York, United States. |

Continued its Phase 3 program for giroctocogene fitelparvovec, an investigational gene therapy for severe hemophilia A. |

|

Novartis AG |

Basel, Switzerland. |

It received FDA approval for Itvisma for children two years and older, teens, and adults with SMA. |

Segmentation Analysis

Therapy Type Insights

Which Therapy Led the Cell & Gene Therapy Market in 2024?

In 2024, the cell therapy segment held the dominating share of the market. Its beneficial part is tissue regeneration and repair for chronic and degenerative diseases, including arthritis and heart disease, with a cure for particular issues, like sickle cell disease. In this era, many clinical trials are executing CAR-M (engineered macrophages) and natural killer (NK) cells for diverse blood cancers. In June 2025, more than 6,000 global interventional cell therapy trials were registered, as well as more than 2,154 of these being genetically modified cell therapies (like CAR-T).

Therapeutic Class Insights

Why did the Infectious Disease Segment Dominate the Market in 2024?

The infectious disease segment captured the biggest revenue share of the cell & gene therapy market in 2024. Market leaders have spurred numerous clinical trials for these diseases by using cell and gene therapies. Nowadays, researchers are exploring in vivo gene therapy for SARS-CoV-2 employing a soluble ACE2 decoy protein, which protects mice and macaques from infection. It is noted that HIV has been cured by using stem cell transplants from donors who have a natural genetic resistance to HIV (the CCR5 delta 32 mutation).

Oncology

During 2025-2034, the oncology segment is predicted to expand rapidly. Significant drivers are a rise in cases, R&D pipelines, clinical trials, and empowering alliances among pharmaceutical and biotech companies, and other organisations. Recent transformations include developments in CAR-T therapies, such as Carvykti for multiple myeloma and the approval of Adstiladrin, a gene therapy for bladder cancer. Globe is putting efforts into tumor-infiltrating lymphocyte (TIL) therapies for solid tumors.

Diverse Types of Cancer Cases Around the Globe in 2024

Delivery Method Insights

In Vivo Therapy

In the coming era, the in vivo therapy segment is anticipated to expand rapidly in the market. Specifically, this type omits the time-consuming and expensive process of the extraction, modification, and re-infusion. Besides this, they are widely adopting developments in viral vectors, such as adeno-associated virus (AAV), to target specific tissues, like the brain, liver, and muscles, with increased efficacy and specificity. Recently, Luxturna for inherited retinal disease and Zolgensma for spinal muscular atrophy were approved.

End-Use Insights

What Made the Hospitals Segment Dominant in the Cell & Gene Therapy Market in 2024?

In 2024, the hospitals segment captured the largest revenue share of the market. Especially, in India, Christian Medical College (CMC), Vellore, and AIIMS, New Delhi, are greatly fostering cell and gene therapies through clinical trials, mainly for oncology. Whereas these academic medical centers assist in centralising initial material collection, therapy manufacturing, and treatment delivery, simplifying the complex process. Also, they allow integrated "hub-and-spoke" models, linking specialized centers with local practices to expand access to these life-changing but complex treatments.

Trends in the Cell & Gene Therapy Market

1. Exploring Therapeutic Applications

Many strong players are shifting towards the use of these advanced therapies beyond oncology and rare genetic diseases, such as in autoimmune diseases (e.g., lupus, type 1 diabetes), neurodegenerative diseases (e.g., Alzheimer's), and chronic conditions.

2. Adoption of Integrated AI & Data Analytics

Manufacturers are fostering the emergence of AI and machine learning across the R&D and production lifecycle to improve manufacturing parameters, estimate outcomes, with simplify the approval process.

3. Stepping into Promising Investments

The era is promoting investments in ventures that demonstrate robust clinical data, clear commercial viability, and newer approaches to highlight recent bottlenecks.

Future Outlook in Cell & Gene Therapy Market

1. Complementary Efforts in pDNA & mRNA

The prospective period will implement steps in making available high-quality plasmid DNA (pDNA) and messenger RNA (mRNA) manufacturing capabilities that are facilitated by a significant market leader to allow gene editing platforms and therapeutic progression.

2. Substantial Developments in Allogeneic Therapies

Globe will bolster engineered T-cells, such as CAR-T therapies, which are being improved for allogeneic use, to allow rapid and more affordable treatments while lowering production restraints.

3. Emergence of Innovative Technologies

By upgrading the features of technologies used in manufacturing stages, including single-use bioreactors, automated manufacturing platforms, and advanced cryopreservation techniques, which boost robust production pipelines.

Leading Companies in Cell and Gene Therapy Market 2025

The cell and gene therapy market has experienced remarkable growth and progress in recent years, holding immense potential for transforming healthcare with personalized and targeted therapies. Several key players dominate the competitive landscape in this field. To gain a larger share of the market, players are using strategies like investments, alliances, acquisitions, and mergers.

Some of the major market companies include Alnylam Pharmaceuticals Inc., Amgen Inc., Biogen Inc., CORESTEM Inc., Dendreon Pharmaceuticals LLC., Helixmith Co. Ltd., JCR Pharmaceuticals Co. Ltd., Kolon TissueGene Inc., Novartis AG, and Pfizer Inc.

Browse More Insights of Towards Healthcare:

The global cell and gene therapy (CGT) pharmaceuticals market size recorded US$ 16.75 billion in 2024, set to grow to US$ 19.91 billion in 2025 and projected to hit nearly US$ 91.56 billion by 2034, with a CAGR of 18.93% throughout the forecast timeline.

The global cell and gene therapy CRO market size is estimated at US$ 4.90 billion in 2024, is projected to grow to US$ 5.39 billion in 2025, and is expected to reach around US$ 12.59 billion by 2034. The market is projected to expand at a CAGR of 9.9% between 2025 and 2034.

The global cell and gene overexpression service market size is calculated at US$ 771.40 million in 2024, grew to US$ 805.73 million in 2025, and is projected to reach around US$ 1,192.24 million by 2034. The market is expanding at a CAGR of 4.45% between 2025 and 2034.

The global cell and gene therapy thawing equipment market size recorded US$ 0.96 billion in 2024, set to grow to US$ 1.1 billion in 2025 and projected to hit nearly US$ 3.56 billion by 2034, with a CAGR of 14.24% throughout the forecast timeline.

The global cell and gene therapy cold chain logistics market size is calculated at US$ 1.89 billion in 2024, grew to US$ 2.19 billion in 2025, and is projected to reach around US$ 8.06 billion by 2034. The market is expanding at a CAGR of 15.64% between 2025 and 2034.

The global cell and gene therapy isolator market size is calculated at USD 1.35 billion in 2024, grew to USD 1.52 billion in 2025, and is projected to reach around USD 4.47 billion by 2034. The market is expanding at a CAGR of 12.54% between 2025 and 2034.

The cell and gene therapy manufacturing market size is estimated to be USD 5.08 billion in 2024 to reach an estimate of USD 22.88 billion by 2034, at a 16.25% CAGR between 2025 to 2034.

The global cell and gene supply chain solutions market size is calculated at US$ 3.54 billion in 2024, grew to US$ 4.09 billion in 2025, and is projected to reach around US$ 14.95 billion by 2034. The market is expanding at a CAGR of 15.54% between 2025 and 2034.

The global cell and gene therapy tools and reagents market size is calculated at US$ 10.04 billion in 2024, grew to US$ 11.12 billion in 2025, and is projected to reach around US$ 27.3 billion by 2034. The market is expanding at a CAGR of 10.76% between 2025 and 2034.

The global cell and gene therapy manufacturing QC market size is calculated at USD 2.66 billion in 2024, grew to USD 3.11 billion in 2025, and is projected to reach around USD 12.35 billion by 2034. The market is expanding at a CAGR of 16.89% between 2025 and 2034.

Segments Covered in the Report

By Therapy Type

- Cell Therapy

- Stem Cells

- T Cells

- Dendritic Cells

- NK Cells

- Tumor Cells

- Gene Therapy

By Therapeutic Class

- Cardiovascular Disease

- Cancer

- Genetic Disorder

- Rare Diseases

- Oncology

- Hematology

- Ophthalmology

- Infectious Disease

- Neurological Disorders

By Delivery Method

- In Vivo

- Ex vivo

By End-Users

- Hospitals

- Cancer Care Centers

- Wound Care Centers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5052

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.